ASX200 ends in the red, down 0.39pc on a dark and murky Thursday

Energy Sector adds 1.4pc, offsetting broader falls after oil surged overnight

Small Cap Winners include Culpeo Minerals and Orion Equities

ASX Energy stocks surged on Thursday offsetting what would’ve been a shocker as a grab bag 0f stocks on the ASX lost ground on Day 3 of 2024.

Anxieties out of the Middle East lifted global oil prices while Asian markets tracked Wall Street lower as US investors fell into fresh depression upon a US FOMC minutes suggesting no extravagant early cuts.

Aside from a stonker of a day for Energy stocks, most ASX sectors were in or flirting with the red at the close.

At 4pm on Thursday, the ASX200 was more than 29 points or 0.39% lower at 7494:

Firstly, let’s not go overboard with this Fed minutes business.

The latest read of the Federal Open Market Committee’s thinking suggests a lot more of the same-same we enjoyed in 2023 – a ‘high level of uncertainty’ over the timing and size of the weapon involved in future US interest rate cuts.

But this is still a vast improvement on ‘higher for longer.’

Fed officials did seem to acknowledged US rates are at the peak of a brutal tightening cycle – noting that upcoming rate decisions hinge on how the data falls for the US economy over the coming months is merely par for the course.

The Fed’s thinking, the mins read…

“…largely converged around the view that the peak level of the federal funds rate for this tightening cycle had been reached… (and) the first reduction in the policy rate would occur in June, unchanged from the October surveys. The average path for the policy rate implied by market pricing shifted down considerably over the period.

“Participants viewed the policy rate as likely at or near its peak for this tightening cycle, though they noted that the actual policy path will depend on how the economy evolves.”

At home, Energy was the only sector trading in the green at lunchtime, tracking higher oil prices. Brent crude rose to $US78 a barrel amid tensions in the Middle East and OPEC+ reaffirmed its commitment to keep the market stable via a statement on its website.

Overnight WTI crude futures enjoyed their biggest single daily gain since November.

Behind the bump are new supply concerns out of Libya and renewed Middle East tension as well as a much smaller than expected read on US output.

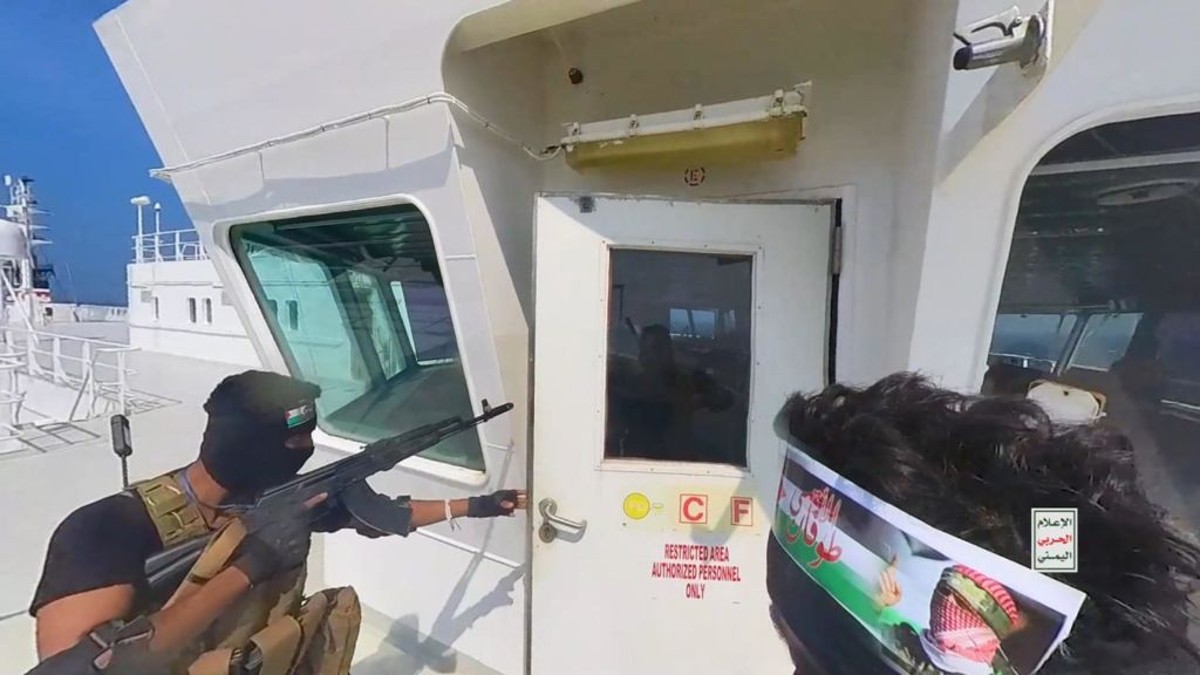

Meanwhile, in the iuncreasingly exciting Red Sea, Iranian-backed Houthi militants out of Yemen have told everyone they’ve gone and attacked another carrier, while a huge explosion that killed almost 100 people in central Iran bears the fingerprints of Israel, but can’t be confirmed ‘cos that’s a plausible deniability thing.

Upshot at home? Well. Energy’s saved the day from being a bit of a Red Sea. The sector gained around 1.4% and majors Woodside Energy Group (ASX:WDS) , Santos (ASX:STO) and Ampol (ASX:ALD) all rallied around 1%.

Elsewhere the coal players impressed for the first time in ’24, led by Yancoal Australia (ASX:YAL) which climbed almost 4%. Whitehaven Coal (ASX:WHC) added 2.8%

And a few of those uranium players also had a chance to remind the market of the potential shown late last year. Here’s the best of the S&P/ASX 200 Energy (XEJ) at 3.30pm in Sydney…

Via MarketIndex

ASX Consumer stocks suffered, alongside the IT Sector majors and most materials stocks.

ASX SECTORS at 4.15pm on THURSDAY

Chart via MarketIndex.com.au

Around the ‘hood, Asian markets fell on Thursday.

Japanese shares led the selling as the country staggered under a one-two blow of the New Year’s Day earthquake and a fiery collision at Tokyo’s Haneda airport. Stocks in South Korea, Hong Kong and mainland China also declined.

Hong Kong’s Hang Seng index and China’s CSI were about 1% lower while South Korea’s Kospi shed 0.8%.

Fresh from a midweek holiday, the Nikkei 225 Index crashed around 2%, while the broader Topix shrank by around 1.5% as markets played catch the knife after all the bleeding everyone else enjoyed on Wednesday.

Most Fed officials said they wanted to maintain higher rates, yet expressed fears of how “overly restrictive” monetary policy could whack the US economy.

Overnight the Dow and S&P500 fell 0.75% and 0.8%, disrespectively, with the latter sliding for a third straight sesh.

The Nasdaq also dropped 1.2%, extending its losingness to a fourth day.

Eight out of the 11 S&P500 sectors ended redly. Real estate, Consumer Discretionary, the worst and Energy, the best. Like us.

Those moves came as the slick greenback and tired old US Treasury yields gained some ground, as the punters pared back their jubilant betting on the whole interest rate cuts thing.

US stock futures have steadied on Thursday in Sydney:

Finally, Bitcoin and its ilk were also in decline during the Wednesday session in New York.

Euphoria that the US government will soon approve Bitcoin exchange-traded funds has flowed more than ebbed into the New Year, but there’s doubt now, and it’s creeping.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

Out in front of Small Caps land early was Culpeo Minerals (ASX:CPO), which – it seems – is unable to stop delivering great news, backing up December’s big announcement with a fresh one this morning about the company delineating a “large (1.7km x 0.5km footprint) copper-gold porphyry system” at its La Florida Prospect, inside the Fortuna Project in Chile.

Culpeo says that surface sampling results have returned grades up to 3.96% Cu and 2.61g/t Au, with mineralisation styles that are analogous to the company’s Lana Corina Prospect, which itself returned drill intersections of 257m @ 1.10% Cu Eq and 169m @ 1.21% CuEq.

Orion Equities (ASX:OEQ) was continuing its efforts to make hay off the back of yesterday’s announcement that its subsidiary CXM Pty Ltd stands to pocket about $5 million in a royalty payment from Miracle Iron Holdings. That’s after Miracle moved to acquire the Paulsens East Iron Ore Project located in the Pilbara, Western Australia from Strike Resources (ASX:SRK).

There was a large spike in interest in Talisman Mining (ASX:TLM) during the morning, despite zero news from them, which has led to a 25.5% spike in value – the reason for that should become evident soon enough… just not, apparently, today. It eased to a 21.8% gain by the end of the session.

And yesterday’s high-flyer, Pan Asia Metals (ASX:PAM), is also continuing its blistering run, up another 15.8% on recent news that it is set to acquire a 100% interest in the massive Tama Atacama Chilean lithium brine asset, which comprises some 1,200km2 of “Tier 1” ground.

iCandy Interactive (ASX:ICI) copped a speeding ticket from the ASX today, after a no-news rise from from a low of $0.027 to an intraday high of $0.04 today – however, the Aussie videogame company has come back with a “we’re not sitting on any info that everyone else doesn’t know about” reply.

But it was enough of a jump to propel the company into the upper reaches of the winner’s circle today, to the tune of around +26%.

MTM Critical Metals (ASX:MTM) made a remarkable recovery from yesterday’s form slump, which saw it shed 23% of the back of news that drilling results “further confirm rare earth element (REE) and niobium (Nb) mineralisation over broad intervals in previously untested parts of the Pomme carbonatite complex”.

MTM took off at a brisk pace around 2:00pm, closing out the day 50% better off at $0.105 per share.

Similarly, Rincon Resources (ASX:RCR) managed a roughly 25% spike today after losing a fair bit of ground yesterday, closing out proceedings at $0.032 a pop.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

Trading Halts

Nope. Day 2 of no halting. If this keeps up, we’re going to have to fire the work experience kid.

The post Closing Bell: Rising Red Sea dramas rescue ASX from ruder sea of red dramas appeared first on Stockhead.

+ There are no comments

Add yours