There are signs that private cap raising are on the rebound

ASX-listed Complii saw more than $10 billion raised through its platform in FY23

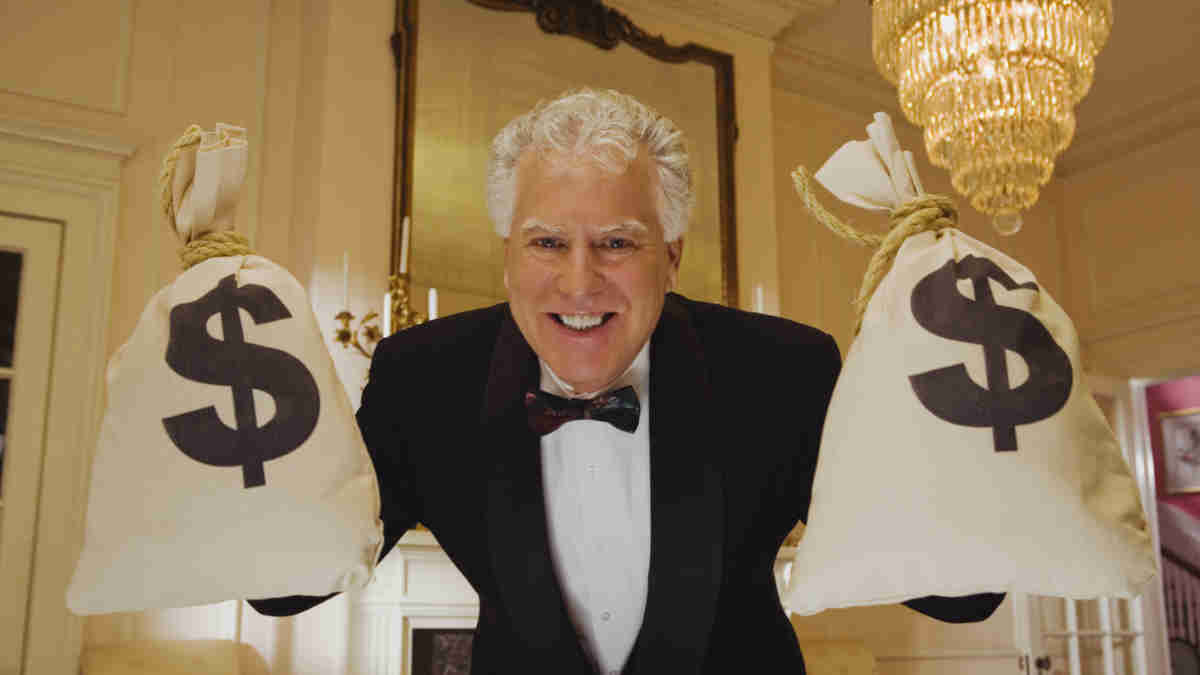

Stockhead reached out to Craig Mason, executive chairman of Complii

A slowing global economy, along with recession concerns and geopolitical headwinds, have slowed capital raising in 2023.

A recent report suggests that Asia-Pacific private capital funding is on course to make 2023 the lowest fundraising year in a decade.

But amidst this downturn, some promising signs of a potential rebound have recently emerged.

Bain & Company predicts that full-year fund-raising totals globally will likely come in at US$1 trillion, out of a total of US$3.3 trillion sought by private capital funds. Although the 3.3x gap is huge, it shows that large number of companies are still out there looking for funds.

In Australia, more than $10 billion in private capital was raised in FY23 alone through a platform provided by ASX-listed fintech firm, Complii Fintech Solutions (ASX:CF1).

According to Complii, the funds were raised via more than 3000 financial advisers, stockbrokers and Australian Financial Services Licence (AFSL) holders who accessed the platform as part of the Complii network.

“$10 billion is a big number, which points to the fact that 80% of all cap raise equity transactions in Australia are being done through the Complii platform. So, ours is a pretty extensive network,” said Craig Mason, executive chairman of Complii.

Mason adds that while the global economy is obviously on a down cycle right now, companies will always need capital.

“The fact that we’re still seeing a lot of activity on our platform – $2bn in Q1 across 800 deals – is a testament to the fact that activity in the unlisted space is still going on. It’s just not as visible as IPOs and listings.”

Facilitating deal flow in the market

Mason concedes that the landscape is tough out there, particularly for those companies chasing a public listing, so there’s a far greater focus on the unlisted space at the moment.

“There’s still a lot of private capital waiting to be deployed; the current environment has indeed altered the pricing of the capital, but there’s no shortage of it,” he told Stockhead.

Mason explained that Complii’s client base, who are still very active in raising funds, include the Canaccords of the world, the Euroz Hartleys, the Shaws and the Argonauts.

“Basically anyone in that cap raising space, they use our platform to provide highly efficient deployment and distribution of those capabilities and products to their clients,” said Mason.

Companies looking to raise those funds meanwhile are a mixed bag, which include those looking for seed, Tier 2 raising, right through to cap raises by listed firms and trusts.

“Prior to our service, a broker or a financial adviser might pass on deals for lack of potential investors. Conversely, they might not be receiving as many deals as they could.

“However, with Complii, deal flow is increased via access to a larger pool of dealers through the online Complii community.

“We look forward to growth of this service as the demand for private market fund raising accelerates,” Mason says.

Other platforms under the Complii umbrella

Under the Complii umbrella also sits Primary Markets, a platform that has over 100 investment opportunities and 110,000 contacts, comprising a mixture of secondary trading, trading hubs, unicorns, capital raises and investor centres.

“The Primary Markets business is a platform for companies that are listed or privates, to have an investor hub to communicate with their shareholders, and they can also create liquidity through that platform,” said Mason.

Former ASX-listed company Splitit is a good example of a company that has moved to the Primary Markets platform since de-listing, along with giant gaming company, VGW.

Another platform under the Complii network is the recently acquired Mintegrity, which provides a regulatory advisory and automation platform for financial service providers in Australia.

Mintegrity’s solutions include its digital regulatory web service RegsWeb and its e-learning portal MIWize, which equips professionals with knowledge on how to meet regulatory requirements.

And there’s also ThinkCaddie, a platform that delivers content to financial professionals and helps organisations manage their team with customisable training plans, real time progress overviews, one-click reporting, and automated follow ups.

‘Reg Tech is not going away’

Complii is essentially a SaaS business with a whole plethora of capabilities that fit within the financial services sector.

“You have the ASX, which provides market liquidity, you have market data through things such as Iress, then you have execution and clearing providers.

“Where we sit is that we’re in the centre of all that, the backbone of the financial services industry if you will,” said Mason.

“I facetiously say that building tech is easy, and getting clients is hard, but it’s actually the opposite way around for us.

“If you look at our customer base, you will see the who’s who of the entire financial services industry in Australia outside of the bulge brackets.”

“We’re basically in the Reg Tech space, and Reg Tech is not going away,” Mason added.

“A lot of our customers are also shareholders of the company.

“So for an investor who wants to get access to a financial services technology company that has a significant footprint in the customer base, and will escalate its revenue as a result of market improvement, we’re really an interesting place to invest.”

Complii share price today:

The post As the market rebounds, ASX-listed Complii could ride the wave of surging private equity deals appeared first on Stockhead.

+ There are no comments

Add yours