Gold prices surge to new heights, breaching $2,400/ounce mark

Silver joins the rally, breaking $30/ounce barrier and pushing gold-silver ratio below 80

Commodities boom extends to copper and uranium

Stock of the Week: PacGold (ASX:PGO)

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Gold sets another record

Figure 1: 50-year gold price chart (Source: https://tradingeconomics.com/commodity/silver, 17 May 2024.)

Gold prices (figure 1) set new records last week breaking through US$2,400/ounce to close at US$2,414/ounce at the close of trading on Friday which, according to Adam Button, head of currency strategy at Forexlive.com, is a continuation of the broader rally.

According to Button “This rally started in China, and China continues to show up”. He also noted that recent data showed Turkey and much of the Middle East are also buying bullion.

Gold today broke through all time highs and is now trading at US$2,444/ounce.

Apparently Russian President Vladimir Putin and Chinese Premier Xi Jinping is also very bullish for gold prices. You can’t help thinking that the world is looking for an alternative to the US dollar.

In addition to the central bank activity that I have mentioned here in recent articles, David Einhorn, from Greenlight Capital noted that in the fourth quarter of 2023 hedges fund purchased US$74 million worth of shares in SPDR Gold Shares (NYSE: GLD), the world’s largest gold-backed exchange traded fund (“ETF”).

In a recent Kitco interview, Sean Lusk from Walsh Trading believes that high inflation, massive debt issuance, and runaway central bank currency printing is seeing market players increase their weightings towards precious metals and commodities.

In other words, a “perfect storm of bullishness” according to Lusk.

Silver has also caught fire after a slow start in the first quarter of this year with gains outpacing gold. Silver recently broker the psychological barrier of US$30/ounce with silver futures trading up to US$30.74/ounce up 3% on Friday representing an 11-year high (figure 2).

This has helped push the gold-silver ratio below 80 (figure 3).

Figure 2: 25-year gold price chart (Source: https://tradingeconomics.com/commodity/silver, 1 May 2024.)

Figure 3: 5-year gold-silver ratio chart (Source: https://goldprice.org/gold-silver-ratio.html, 17 May 2024.)

Talking of commodities on fire look no further than copper which reached all times highs of US$5.13/lb last week before settling back at US$5.08/lb on Friday for a massive 9.1% or 46 gain on the week.

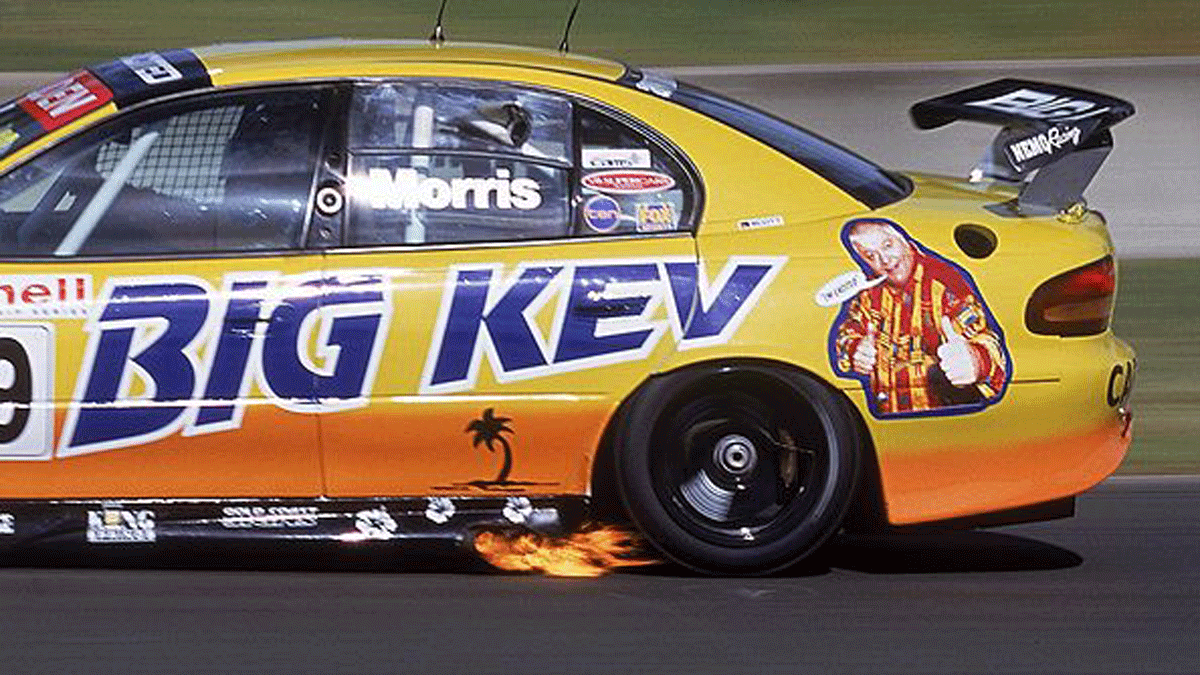

I wonder what the late great Big Kev (the Stockhead faithful would remember that larger than life Queensland promoter of Australian made cleaning products) say.

No doubt “I’m excited’.

Figure 4: 25-year copper price chart (Source: https://tradingeconomics.com/commodity/copper, 17 May 2024.)

Last month commodities assets under management surged 7.1% (month on month) and 11.1% year to date. Notable was the increase in ETF market capitalisations (predominantly gold and silver) that increased by just over US$390 billion to US$435 billion just short of the record US$435 billion reached over March-April 2022.

Figure 5: Uranium spot price (Source: https://world-nuclear.org/information-library/nuclear-fuel-cycle/uranium-resources/uranium-markets, 12 May 2024.)

Uranium prices (figure 5) have eased to just under US$91/lb after reaching two-month highs of US$94/lb earlier this month as the market digests the recent ban on Russian uranium by the US that I mentioned here last week.

I anticipate that the recent production downgrades from Canada and Kazakhstan, along with the desire by over 20 countries to triple nuclear power by 2050 will keep the wind in Uranium’s sales.

China is the main player here and is planning to build 22 of 58 global reactors.

Stock of the Week: PacGold

Figure 6: PGO 2-year share price chart (Source: CMC Markets, 20 May 2024).

With gold on a tear, I thought it was time to dig into the vault to see what I had turned up in the last year or so that may be worth revisiting.

I caught up with Pacgold (ASX:PGO) geologist, managing director and former North Flinders Mining colleague for dinner the other day and he did remind me that I gave him an honourable mention as well as accusing him of something unspeakable in our formative years at North Flinders (well Tony, if it was printed here it must be the gospel truth) in February last year.

Whatever happened is a little fuzzy, but I was probably sound asleep in the back of a Toyota Landcruiser at the time.

Anyway, I thought it was time for a recap on the company given exploration had continued to deliver excellent results at its 100% owned Alice River project (Queensland) (figure 7) over the last 18 months or so.

Drilling has continued to demonstrate the potential of Alice River to deliver high-grade gold intercepts that are providing encouragement for a substantial maiden mineral resource estimate in 2H of 2024 in the order of +400,000 ounces of circa 5g/t gold (my estimate).

Mineralisation should be accessible via open pit and underground with plenty of room for resource expansion over a 30km strike length (figure 8) including Posie to the north-west which recently returned an intercept of 4m @ 11.5g/t gold.

Figure 7: PGO’s Alice River Project in Queensland (Source: PAC Gold Presentation, 26 March 2024).

There is plenty of near-term upside with the Central Target (figure 9) in particular remaining wide open with plenty of impressive intercepts including the F1a zone with;

• 17m @ 9.3g/t Au

• 24m @ 8.0g/t Au

• 14.9m @ 10.3g/t Au

The company may look to do a raise in the near term, I suspect, given the cash balance was $2.47 million at the end of March, however with solid news flow in a rising gold market, an enterprise value of around $11 million would give you a valuation of under $30/ounce assuming a maiden resource in the order of 400,000 ounces later this year.

Figure 8: PGO’s Alice River Project targets and IP resistivity (Source: PAC Gold Presentation, 26 March 2024).

Figure 9: PGO’s Central Target showing historical drilling and potential extensions (Source: PAC Gold Presentation, 26 March 2024).

I don’t want to give too much credit to Queenslanders given they are living off our GST, together with the prevalence of gold chains and white shoes as well as their excessive consumption of beer, however such a modest valuation would suggest there is a dollar to be made here for the Stockhead faithful.

Guy Le Page is a director and responsible executive at Perth-based financial services provider RM Corporate Finance. A former geologist and experienced stockbroker, he is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The post Guy on Rocks: 400,000oz of high-grade gold? Room for expansion? I’m excited! appeared first on Stockhead.