China, Turkey and India led ongoing central bank gold buying in April

Analysts still see gold continuing higher this year, heading ‘easily’ above US$2,500

Iceni Gold absolutely slays it on the ASX this week with +200% gain

In the week’s most tenuous (possibly) world macroeconomics analogy on Stockhead, we refer you to American country singer Jerry Reed’s early ’80s hit – She Got the Goldmine, I Got the Shaft.

Why? Because it’s Friday and we’re scratching around for content that speaks to us – even if it’s a solid gold earworm with an amusing title.

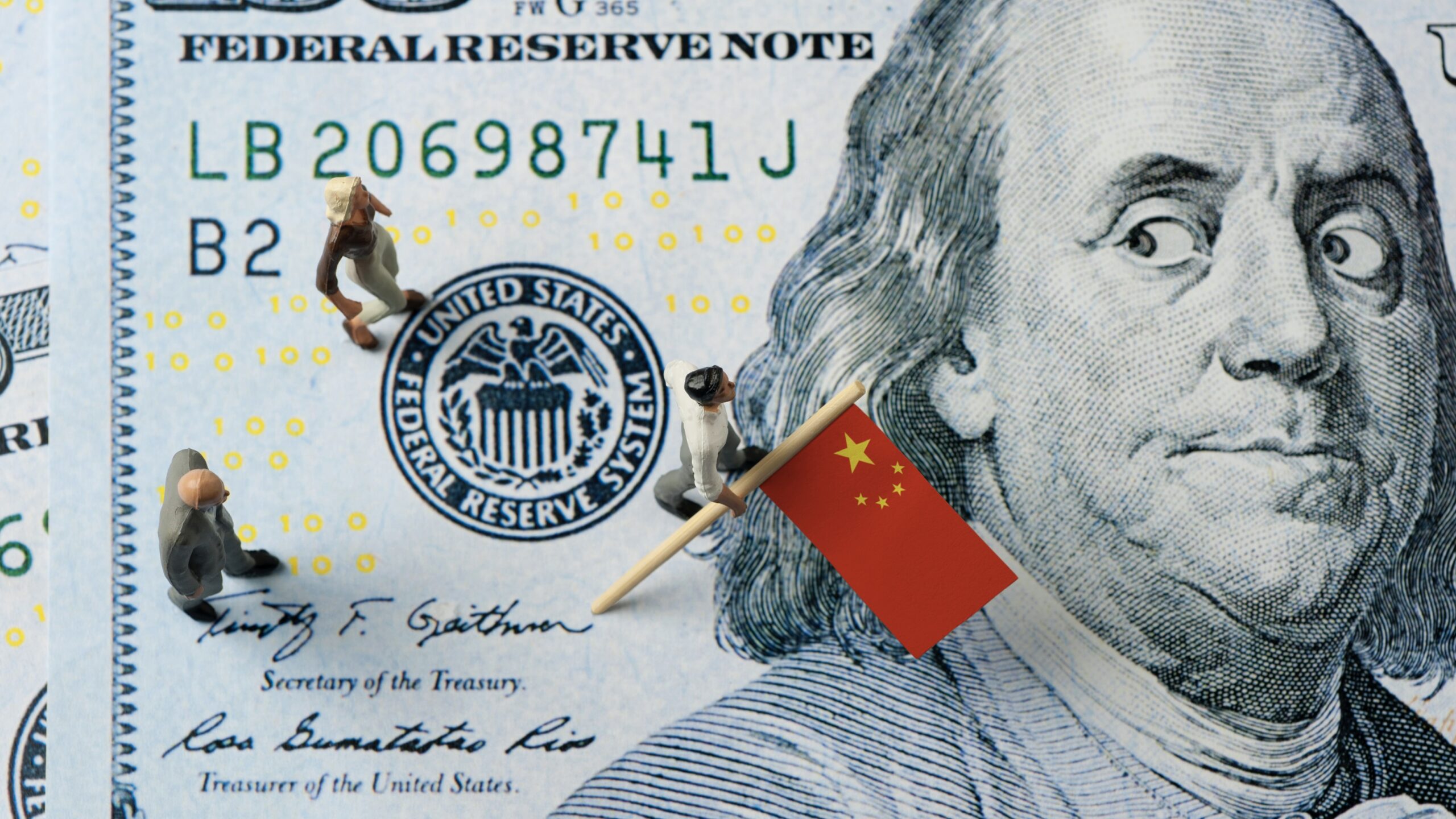

And… also because China keeps on buying gold in an attempt to protect itself against its shaky economic sitch, while America slowly digs itself a great big, inflating hole of irreversible debt of its own.

In the ditty, the antagonist gets the spoils, while the protagonist is left with little else to show but a broken heart and a steaming hot mess of financial woe. Perhaps the shaft, in this sense, is made from US currency.

In a global sense, the prominent BRICS Eastern powerhouse very much aims to be the ‘antagonist’ as it looks to diversify away as fast as it can from the US dollar. And that’s in order to reduce its geo-economic vulnerabilities within the overarching dollar-dominated global economic system.

China is the world’s largest consumer of gold. According to broker Citi (via a Carl Capolingua article for Market Index), China gobbles up about 60% of global mine production, and around two-thirds of all annual global gold supply.

The US dollar, meanwhile, as remarkably strong as its been of late (thanks to the US Federal Reserve’s interest rate hiking and holding), might well be due some crumbling at the edges if (more likely when) the Fed turns the money printer back on come the US election – in order to help Sleepy Joe look like he’s actually doing something right by the American people.

In just about any future you look at, though – sticky, untameable inflation/stagflation; the eventual predicted rate cuts still likely this year from a Fed that says it’s got it under control; and then a Biden win or a supposedly nightmarish Trumpian apocalypse… gold’s actually looking like one of the very best places to park money as a safe haven.

Same as it ever was.

Here’s the song. Like we said, earworm.

You’re back. And so is gold. It’s up again at the time of writing with a +0.3% gain.

In US dollars it’s doing the rounds at $2,357, and in the Aussie version, which always sounds better, it’s changing hands around $3,567. Handy.

Time for some second-hand analysis, some news items, and then some ASX goldie action.

First up, who better to turn to than a global council that dedicates itself round the clock to the deeply analytical study of the gold market and its machinations? No one, that’s who.

The latest from the World Gold Council

The World Gold Council (WGC) this week released its Gold Market + ETF commentary reports for April.

It’s a long read. Worth it, but long. So we’ve cherry picked what we need here.

Essentially, April saw gold gains slow compared to a strong March, rising 4% over the month, despite hitting an all time high again, earlier in the month.

The cool off/”new-high fatigue” was due, says the council, to falling Chinese premia, lower Indian imports and flat-lining COMEX (Commodity Exchange Inc) positioning.

That said, the trajectory is still up for gold overall. And the reason we’re banging on about China above, is the fact its central bank is still buying up the precious metal like there’s no more to be found in the ground ever again. Which is ridiculous, of course – it’s not exactly a 100% finite hard currency, is it – like Bitc… nothing.

“For gold-backed ETFs, Asia-led global inflows and North American funds registered positive demand,” noted the WGC.

That said, these were dwarfed by European outflows. “Physically backed gold ETFs saw outflows of US$2bn in April, further extending aggregate losses to 11 consecutive months”.

Australian Gold ETFs were down just 1%, by the way.

Some WGC-noted positive thoughts/upshot for gold going forward, though:

• China’s PBoC and other central banks have continued to load up on gold in April. The biggest buyers in April included China, Turkey, and India.

Source: World Gold Council; IMF IFS, Respective central banks

• Inflation in the US remains sticky, “and the outlook seems to point once again to ‘stagflation’ which, in turn, is helping the case for gold and could encourage Western investors to join strong demand from Central banks and Far East buyers.

• “As we move from soft landing to higher-for-longer, while the Fed is not in any rush to cut rates, the rest of the economic picture may provide more incentives for Western investors to join the Eastern counterparts in adding gold to their investment strategies.”

Some other tidbits worth a mention

• Across the Atlantic, the Bank of England (BoE) has unsurprisingly kept its rate unchanged at 5.25%, in line with consensus. This has seemed to help buoy stock markets today, and the price of gold. Bitcoin, too.

• Gold’s price rise late this week is also being attributed to Chinese trade data showing a greater-than-expected rise in Chinese exports of 1.5% year-over-year in April, rebounding from a 7.5% drop a month earlier. This info comes per an fxstreet.com report, which reads:

According to the data, imports rose 8.4%, beating the 5.4% forecast and the previous 1.9% drop. China is a key player in the global market for gold so strong economic data from the country impacts its valuation.

• Meanwhile, in conversation with precious metals-focused media outlet Kitco this week, Jeff Clark, editor of TheGoldAdvisor.com, noted that while central bank buying has indeed been supportive of gold prices, interest rate cuts later this year could send the metal higher.

“This could be a banner year for central bank gold buying,” said Clark. “In my humble opinion, that is not why the gold price is higher. I think central bank gold buying actually supports the price though. It’s just an important component of this market,” he said, adding:

“$2,500 is easily within reach this year.”

• On the price prediction side of things, just returning to the Market Index article mentioned further above, and Capolingua notes that the Citi brokers, while of the belief gold could be a tad overextended in the short term, are “clear gold bulls”.

He notes:

They tip the gold price could trade with a ‘3’ handle for the first time ever in the not-too-distant future, given their ‘base case’ is for gold to hit US$3,000/oz within the next 12-15 months.

“The era of a unipolar world is crumbling, giving way to the rise of a multipolar global order…”

Read: https://t.co/LLh5LkyJt4

— Gold Telegraph (@GoldTelegraph_) May 8, 2024

ASX Winners & Losers

Here’s how ASX-listed precious metals stocks are performing, circa 4pm May 10:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Please email [email protected]

Code Company Price % Week % Month % Year Market Cap MRR Minrex Resources Ltd 0.0115 -4% -12% -1% $13,018,410 NPM Newpeak Metals 0.021 5% 91% 1% $2,499,605 ASO Aston Minerals Ltd 0.012 9% 0% -1% $14,245,707 MTC Metalstech Ltd 0.27 26% 64% 5% $47,238,648 FFX Firefinch Ltd 0.2 0% 0% 0% $236,569,315 GED Golden Deeps 0.039 -3% -13% -1% $4,620,894 G88 Golden Mile Res Ltd 0.012 -8% -14% -1% $4,934,674 DCX Discovex Res Ltd 0.002 0% 0% 0% $6,605,136 NMR Native Mineral Res 0.022 10% -27% 0% $4,616,711 AQX Alice Queen Ltd 0.007 40% 17% 0% $4,145,940 SLZ Sultan Resources Ltd 0.011 -8% -8% -1% $2,173,451 MKG Mako Gold 0.013 -7% -13% 0% $13,176,110 KSN Kingston Resources 0.073 9% 3% 0% $46,893,376 AMI Aurelia Metals Ltd 0.18 -10% -3% 7% $321,055,807 PNX PNX Metals Limited 0.0045 -10% -10% 0% $26,865,966 GIB Gibb River Diamonds 0.024 -23% -23% -1% $5,076,227 KCN Kingsgate Consolid. 1.79 15% 26% 42% $407,247,673 TMX Terrain Minerals 0.003 -25% -25% 0% $4,295,012 BNR Bulletin Res Ltd 0.053 8% 8% -9% $14,680,666 NXM Nexus Minerals Ltd 0.068 1% -16% 2% $25,288,908 SKY SKY Metals Ltd 0.044 29% 16% 1% $26,691,343 LM8 Lunnonmetalslimited 0.29 0% 9% -31% $63,174,577 CST Castile Resources 0.088 -2% 22% 1% $22,738,828 YRL Yandal Resources 0.115 -8% -4% 3% $30,797,876 FAU First Au Ltd 0.003 50% 50% 0% $3,323,987 ARL Ardea Resources Ltd 0.665 2% -6% 19% $129,715,895 GWR GWR Group Ltd 0.11 0% 13% 2% $35,333,832 IVR Investigator Res Ltd 0.055 20% 10% 2% $82,361,738 GTR Gti Energy Ltd 0.005 -17% -17% 0% $11,274,709 IPT Impact Minerals 0.022 10% 57% 1% $63,023,486 BNZ Benzmining 0.14 -7% -18% -11% $16,381,265 MOH Moho Resources 0.005 25% 0% -1% $2,156,713 BCM Brazilian Critical 0.026 8% 30% 0% $17,902,964 PUA Peak Minerals Ltd 0.003 0% 0% 0% $3,124,130 MRZ Mont Royal Resources 0.055 8% -8% -10% $4,676,639 SMS Starmineralslimited 0.03 -19% -25% -1% $2,277,684 MVL Marvel Gold Limited 0.009 0% -10% 0% $7,774,116 PRX Prodigy Gold NL 0.0025 0% -17% 0% $5,034,435 AAU Antilles Gold Ltd 0.011 -21% -44% -1% $10,356,885 CWX Carawine Resources 0.105 5% -5% -1% $24,793,172 RND Rand Mining Ltd 1.57 0% 0% 20% $89,295,259 CAZ Cazaly Resources 0.018 0% -10% -1% $7,728,818 BMR Ballymore Resources 0.155 24% 19% 3% $24,742,282 DRE Dreadnought Resources Ltd 0.017 0% 0% -1% $63,235,313 ZNC Zenith Minerals Ltd 0.075 -9% -23% -8% $28,190,471 REZ Resourc & En Grp Ltd 0.013 0% 0% 0% $8,109,475 LEX Lefroy Exploration 0.098 -11% -25% -8% $19,845,390 ERM Emmerson Resources 0.051 11% 4% -1% $27,235,489 AM7 Arcadia Minerals 0.06 -18% -38% -1% $7,088,257 ADT Adriatic Metals 4.58 -1% 9% 57% $1,149,615,496 AS1 Asara Resources Ltd 0.011 10% 22% 0% $10,586,104 CYL Catalyst Metals 0.83 -7% 19% 3% $172,814,884 CHN Chalice Mining Ltd 1.435 29% 15% -26% $560,107,158 KAL Kalgoorliegoldmining 0.029 -15% -9% 0% $4,755,022 MLS Metals Australia 0.021 5% -5% -2% $14,854,760 ADN Andromeda Metals Ltd 0.0175 -3% -8% -1% $59,095,148 MEI Meteoric Resources 0.2125 -6% -11% -5% $417,925,167 SRN Surefire Rescs NL 0.01 0% 0% 0% $21,849,386 SIH Sihayo Gold Limited 0.0025 0% 67% 0% $30,510,640 WA8 Warriedarresourltd 0.062 35% 38% 1% $41,077,283 HMX Hammer Metals Ltd 0.039 -9% -19% -1% $34,569,887 WCN White Cliff Min Ltd 0.0165 10% 10% 1% $27,614,586 AVM Advance Metals Ltd 0.024 -8% -37% -2% $1,139,942 WRM White Rock Min Ltd 0 -100% -100% -6% $17,508,200 ASR Asra Minerals Ltd 0.007 0% 0% 0% $11,647,970 MCT Metalicity Limited 0.003 50% 20% 0% $11,212,737 AME Alto Metals Limited 0.037 0% -18% -1% $25,253,311 CTO Citigold Corp Ltd 0.006 20% 20% 0% $18,000,000 TIE Tietto Minerals 0.68 0% 5% 7% $770,506,054 SMI Santana Minerals Ltd 1.115 -3% -16% 11% $224,310,976 M2R Miramar 0.012 33% -20% -1% $1,674,782 MHC Manhattan Corp Ltd 0.002 0% -33% 0% $5,873,960 GRL Godolphin Resources 0.024 -11% -27% -2% $4,966,460 SVG Savannah Goldfields 0.035 25% 40% -2% $7,870,378 EMC Everest Metals Corp 0.11 17% 10% 3% $15,278,329 GUL Gullewa Limited 0.054 -2% -4% 0% $11,057,747 CY5 Cygnus Metals Ltd 0.081 -5% 42% -5% $23,324,731 G50 G50Corp Ltd 0.155 -3% -9% 2% $16,939,950 ADV Ardiden Ltd 0.155 -3% 0% -2% $10,002,801 AAR Astral Resources NL 0.083 32% 26% 1% $61,584,437 VMC Venus Metals Cor Ltd 0.09 8% -10% -1% $17,075,581 NAE New Age Exploration 0.004 0% 0% 0% $7,175,596 VKA Viking Mines Ltd 0.011 10% 10% 0% $12,303,101 LCL LCL Resources Ltd 0.011 -8% -8% -1% $11,462,706 MTH Mithril Resources 0.2 0% 0% 0% $6,737,764 ADG Adelong Gold Limited 0.0035 17% 0% 0% $3,781,711 RMX Red Mount Min Ltd 0.001 0% -50% 0% $4,010,364 PRS Prospech Limited 0.048 9% 23% 2% $12,967,139 TTM Titan Minerals 0.026 -10% 0% 0% $47,043,022 NML Navarre Minerals Ltd 0.019 0% 0% 0% $28,555,654 MZZ Matador Mining Ltd 0.079 14% 44% 3% $39,874,242 KZR Kalamazoo Resources 0.115 31% 17% -1% $16,606,336 BCN Beacon Minerals 0.028 -3% -3% 0% $105,189,509 MAU Magnetic Resources 1.03 0% 5% 1% $279,930,643 BC8 Black Cat Syndicate 0.305 15% 17% 6% $84,852,197 EM2 Eagle Mountain 0.07 -10% 8% 0% $27,108,370 EMR Emerald Res NL 3.53 6% 1% 52% $2,204,759,307 BYH Bryah Resources Ltd 0.007 -13% -30% -1% $3,483,628 HCH Hot Chili Ltd 1.05 -16% -12% -3% $127,806,370 WAF West African Res Ltd 1.44 7% 6% 50% $1,438,835,832 MEU Marmota Limited 0.0435 1% 1% 0% $46,587,225 NVA Nova Minerals Ltd 0.245 -9% -8% -12% $47,919,048 SVL Silver Mines Limited 0.1925 17% -1% 3% $278,986,708 PGD Peregrine Gold 0.23 0% -4% -1% $15,612,037 ICL Iceni Gold 0.089 207% 242% 4% $21,943,934 FG1 Flynngold 0.027 -21% -41% -2% $7,127,252 WWI West Wits Mining Ltd 0.014 -13% -18% 0% $36,455,875 RML Resolution Minerals 0.002 0% 0% 0% $4,830,065 AAJ Aruma Resources Ltd 0.015 0% -25% -1% $2,953,373 AL8 Alderan Resource Ltd 0.005 0% -17% 0% $5,534,307 GMN Gold Mountain Ltd 0.004 0% 0% 0% $11,902,023 MEG Megado Minerals Ltd 0.011 10% 0% -2% $2,799,011 HMG Hamelingoldlimited 0.071 -5% -13% -1% $11,182,500 TBA Tombola Gold Ltd 0.026 0% 0% 0% $33,129,243 BM8 Battery Age Minerals 0.1 -2% 11% -9% $9,176,032 TBR Tribune Res Ltd 4.29 -4% 3% 134% $220,365,923 FML Focus Minerals Ltd 0.145 7% -19% -4% $38,685,417 GSR Greenstone Resources 0.01 18% 0% 0% $15,105,830 VRC Volt Resources Ltd 0.005 0% 0% 0% $24,952,069 ARV Artemis Resources 0.016 -6% -11% 0% $27,059,138 HRN Horizon Gold Ltd 0.32 23% 7% 2% $46,348,775 CLA Celsius Resource Ltd 0.01 -9% -29% 0% $24,279,127 QML Qmines Limited 0.062 -11% -17% -2% $15,326,725 RDN Raiden Resources Ltd 0.0425 25% 37% 0% $108,919,989 TCG Turaco Gold Limited 0.21 11% 17% 8% $157,098,667 KCC Kincora Copper 0.037 -5% -5% 0% $7,173,932 GBZ GBM Rsources Ltd 0.01 0% -17% 0% $11,566,889 DTM Dart Mining NL 0.029 12% -24% 1% $6,719,255 MKR Manuka Resources. 0.06 -15% -33% -2% $45,023,969 AUC Ausgold Limited 0.027 4% -23% -1% $59,699,671 ANX Anax Metals Ltd 0.043 59% 76% 1% $24,835,318 EMU EMU NL 0.03 50% 0% 0% $2,159,775 SFM Santa Fe Minerals 0.047 -4% 0% 0% $3,422,483 SSR SSR Mining Inc. 8.15 1% 12% -767% $34,616,148 PNR Pantoro Limited 0.086 1% 13% 3% $447,546,624 CMM Capricorn Metals 4.7 -3% -13% -1% $1,763,055,905 X64 Ten Sixty Four Ltd 0.57 0% 0% 0% $130,184,182 SI6 SI6 Metals Limited 0.003 0% 0% 0% $7,106,578 HAW Hawthorn Resources 0.07 -7% -7% -2% $23,451,093 BGD Bartongoldholdings 0.315 13% 19% 5% $67,721,670 SVY Stavely Minerals Ltd 0.026 -4% -19% -2% $9,930,442 AGC AGC Ltd 0.12 29% 54% 5% $22,000,000 RGL Riversgold 0.006 -8% -14% -1% $5,805,969 TSO Tesoro Gold Ltd 0.041 5% 52% 1% $51,642,390 GUE Global Uranium 0.11 0% 5% 1% $28,986,465 CPM Coopermetalslimited 0.13 8% 24% -21% $10,578,013 MM8 Medallion Metals. 0.052 -7% -21% -1% $16,307,260 FFM Firefly Metals Ltd 0.89 16% 19% 26% $389,849,977 CBY Canterbury Resources 0.068 13% 209% 4% $10,991,417 LYN Lycaonresources 0.32 -6% 49% 12% $16,690,219 SFR Sandfire Resources 9.8 5% 9% 246% $4,477,545,295 TMZ Thomson Res Ltd 0.005 0% 0% 0% $4,881,018 TAM Tanami Gold NL 0.036 -8% -8% 0% $43,478,591 WMC Wiluna Mining Corp 0 -100% -100% -21% $74,238,031 NWM Norwest Minerals 0.032 -18% 0% 1% $13,584,183 ALK Alkane Resources Ltd 0.6 3% -8% -6% $343,959,271 BMO Bastion Minerals 0.007 17% -13% -1% $3,014,087 IDA Indiana Resources 0.079 -2% 3% 0% $49,467,536 GSM Golden State Mining 0.012 9% 0% 0% $3,073,077 NSM Northstaw 0.036 -10% -20% -1% $5,315,280 GSN Great Southern 0.021 5% -9% 0% $15,532,190 RED Red 5 Limited 0.46 7% 12% 15% $1,541,391,244 DEG De Grey Mining 1.2225 -2% -7% -1% $2,307,659,866 THR Thor Energy PLC 0.017 -6% -23% -1% $3,120,416 CDR Codrus Minerals Ltd 0.043 2% 8% -1% $4,836,828 MDI Middle Island Res 0.015 -12% -12% 0% $3,485,664 WTM Waratah Minerals Ltd 0.105 -13% 40% -2% $19,730,095 POL Polymetals Resources 0.27 -4% 4% -4% $42,556,808 RDS Redstone Resources 0.003 -25% -25% 0% $3,238,825 NAG Nagambie Resources 0.011 -12% -21% -2% $9,559,628 BGL Bellevue Gold Ltd 1.7575 1% -11% 8% $2,007,367,856 GBR Greatbould Resources 0.064 7% 3% 0% $36,633,052 KAI Kairos Minerals Ltd 0.012 9% -8% 0% $28,830,034 KAU Kaiser Reef 0.145 7% -3% -3% $23,090,926 HRZ Horizon 0.04 8% 5% 0% $26,637,380 CAI Calidus Resources 0.13 -4% 0% -9% $98,973,381 CDT Castle Minerals 0.006 0% 0% 0% $7,346,958 RSG Resolute Mining 0.4575 5% -4% 1% $904,846,256 MXR Maximus Resources 0.03 -3% -4% 0% $10,270,265 EVN Evolution Mining Ltd 3.845 -3% -3% -12% $7,526,476,703 CXU Cauldron Energy Ltd 0.041 3% -5% 2% $48,646,025 DLI Delta Lithium 0.315 2% 13% -16% $235,424,357 ALY Alchemy Resource Ltd 0.007 0% 0% 0% $8,246,534 HXG Hexagon Energy 0.02 0% -13% 1% $10,771,234 OBM Ora Banda Mining Ltd 0.3075 -7% -1% 7% $574,897,031 SLR Silver Lake Resource 1.505 6% 14% 32% $1,374,074,170 AVW Avira Resources Ltd 0.0015 0% 50% 0% $2,663,790 LCY Legacy Iron Ore 0.016 -6% 7% 0% $123,416,772 PDI Predictive Disc Ltd 0.2 3% -18% -1% $467,880,397 MAT Matsa Resources 0.031 0% -18% 1% $16,514,254 ZAG Zuleika Gold Ltd 0.018 -10% 6% 0% $13,985,625 GML Gateway Mining 0.015 -6% -32% -1% $5,181,891 SBM St Barbara Limited 0.275 6% 20% 7% $196,312,891 SBR Sabre Resources 0.019 0% -5% -1% $7,110,977 STK Strickland Metals 0.105 0% -13% 1% $169,796,781 ION Iondrive Limited 0.011 38% 22% 0% $3,403,997 CEL Challenger Gold Ltd 0.071 -1% -24% 0% $95,331,346 LRL Labyrinth Resources 0.006 20% 0% 0% $7,125,262 NST Northern Star 14.65 1% -4% 100% $16,667,565,024 OZM Ozaurum Resources 0.065 18% 55% -9% $9,683,750 TG1 Techgen Metals Ltd 0.041 46% 28% -4% $4,612,772 XAM Xanadu Mines Ltd 0.067 -3% -7% 1% $113,256,397 AQI Alicanto Min Ltd 0.02 -13% -20% -2% $12,311,736 KTA Krakatoa Resources 0.017 0% 113% -2% $8,025,823 ARN Aldoro Resources 0.065 -3% -13% -6% $8,750,543 WGX Westgold Resources. 2.23 1% 2% 5% $1,027,761,324 MBK Metal Bank Ltd 0.021 0% -5% -1% $7,809,186 A8G Australasian Metals 0.078 -5% 22% -9% $4,169,640 TAR Taruga Minerals 0.008 0% 33% 0% $6,354,241 DTR Dateline Resources 0.01 -9% -23% 0% $15,980,636 GOR Gold Road Res Ltd 1.62 1% -7% -35% $1,679,184,073 S2R S2 Resources 0.115 -4% -21% -5% $54,342,959 NES Nelson Resources. 0.003 0% 0% 0% $1,840,783 TLM Talisman Mining 0.275 0% 10% 4% $52,729,698 BEZ Besragoldinc 0.096 -3% -13% -5% $38,047,182 PRU Perseus Mining Ltd 2.315 4% -1% 47% $3,159,719,795 SPQ Superior Resources 0.0085 -15% -29% 0% $18,010,984 PUR Pursuit Minerals 0.004 -20% -11% 0% $11,775,886 RMS Ramelius Resources 2.005 2% 1% 32% $2,274,187,307 PKO Peako Limited 0.005 0% 0% 0% $2,635,424 ICG Inca Minerals Ltd 0.007 40% 40% 0% $5,633,172 A1G African Gold Ltd. 0.028 0% -14% 0% $4,543,665 OAU Ora Gold Limited 0.005 0% -17% 0% $29,030,004 GNM Great Northern 0.0105 5% -13% -1% $1,700,920 KRM Kingsrose Mining Ltd 0.038 9% 9% 0% $28,596,008 BTR Brightstar Resources 0.017 6% -11% 0% $49,403,583 RRL Regis Resources 2.11 1% 1% -7% $1,586,211,497 M24 Mamba Exploration 0.023 5% -15% -3% $4,049,810 TRM Truscott Mining Corp 0.063 -10% 9% 1% $10,922,125 TNC True North Copper 0.067 -15% -36% -4% $29,396,959 MOM Moab Minerals Ltd 0.005 0% -17% 0% $3,559,815 KNB Koonenberrygold 0.016 14% -11% -2% $5,180,175 AWJ Auric Mining 0.19 12% -10% 7% $25,254,073 AZS Azure Minerals 3.69 0% 7% -1% $1,692,527,632 ENR Encounter Resources 0.39 0% 50% 10% $164,241,990 SNG Siren Gold 0.076 23% 31% 1% $14,680,769 STN Saturn Metals 0.255 6% 31% 9% $53,760,594 USL Unico Silver Limited 0.15 0% -14% 3% $47,848,255 PNM Pacific Nickel Mines 0.026 -19% -26% -6% $10,456,328 AYM Australia United Min 0.003 0% -25% 0% $5,527,732 ANL Amani Gold Ltd 0.001 0% 0% 0% $25,143,441 HAV Havilah Resources 0.215 0% -9% 2% $63,327,842 SPR Spartan Resources 0.61 6% 4% 9% $629,408,530 PNT Panthermetalsltd 0.039 0% 18% -2% $3,399,480 MEK Meeka Metals Limited 0.036 9% -3% 0% $45,684,230 GMD Genesis Minerals 1.81 6% -7% 2% $1,985,822,005 PGO Pacgold 0.16 0% -14% -3% $12,201,089 FEG Far East Gold 0.125 -7% -24% 0% $32,198,354 MI6 Minerals260Limited 0.145 -6% -6% -18% $32,760,000 IGO IGO Limited 7.95 2% 4% -110% $6,012,706,435 GAL Galileo Mining Ltd 0.27 0% 8% -2% $53,358,730 RXL Rox Resources 0.175 0% -22% -1% $59,096,682 KIN KIN Min NL 0.065 -3% -17% 0% $71,867,183 CLZ Classic Min Ltd 0.0075 7% -32% -4% $2,170,241 TGM Theta Gold Mines Ltd 0.16 7% 3% 5% $113,846,374 FAL Falconmetalsltd 0.155 15% 29% 1% $26,550,000 SXG Southern Cross Gold 3.23 39% 64% 197% $260,087,686 SPD Southernpalladium 0.5 0% 23% 13% $21,539,164 ORN Orion Minerals Ltd 0.02 5% 33% 1% $121,057,150 TMB Tambourahmetals 0.069 1% -5% -5% $5,474,063 TMS Tennant Minerals Ltd 0.022 0% -19% -1% $21,029,589 AZY Antipa Minerals Ltd 0.012 9% -8% -1% $49,617,695 PXX Polarx Limited 0.013 0% -7% 1% $26,643,769 TRE Toubani Res Ltd 0.135 13% 13% -1% $19,243,189 AUN Aurumin 0.043 5% 0% 2% $18,550,899 GPR Geopacific Resources 0.021 -9% -16% 0% $17,256,065 FXG Felix Gold Limited 0.07 -11% 25% 2% $15,748,349 ILT Iltani Resources Lim 0.195 3% 8% 4% $5,781,786 ARD Argent Minerals 0.02 33% 25% 1% $24,596,199

Notable weekly gainers

Iceni Gold (ASX:ICL) +207%

And you can read about that > here

First Au (ASX:FAU) +50%

Southern Cross Gold (ASX:SXG) 39%

The post Gold Digger: China (and Turkey) gobble gold while analysts target US$2,500+ appeared first on Stockhead.