ANZ ratchets up 2030 copper demand forecasts from 35.1Mt to 38.5Mt on Chinese power rush

Bannerman shows capital markets’ enthusiasm for uranium with $85m cap raising

Gold developer De Grey closes in on $1.13b Hemi debt facility, Silex and Yancoal also up

Stockpiling in China and the end of a squeeze in the tight US Comex market has brought copper prices that briefly touched record highs in May back to Earth as the financial year closes.

But banks continue to increase their demand forecasts for the red metal, with little respite for consumers hoping the commodity will get easier to source.

The latest update comes from ANZ’s commodity strategists Daniel Hynes and Soni Kumari.

They say demand growth for copper will rise 4-5% annually over the next five years to 38.5Mt, with aluminium consumption in 2030 to lift from 77.5Mt to 79.5Mt. By way of comparison, the International Copper Study Group estimates 2025 copper usage will sit at around 27.8Mt.

Rising global temperatures and electrification are behind the updated forecasts, with China in particular in dire need of additional transmission infrastructure to connect new power generating capacity.

In the March quarter a whopping 61GW of the 67GW of new capacity that came online was from wind and solar, with renewables now at 49% of its 3TW of generating capacity.

At the same time, the International Energy Agency believes 3000GW of renewable projects are sitting in grid connection queues, Hynes and Kumari said. That’s 5x the amount of solar PV and wind installed in 2022.

“Investment in infrastructure will need to accelerate if shortages are to be

avoided in coming years. This has important implications for critical minerals,” Hynes and Kumari said.

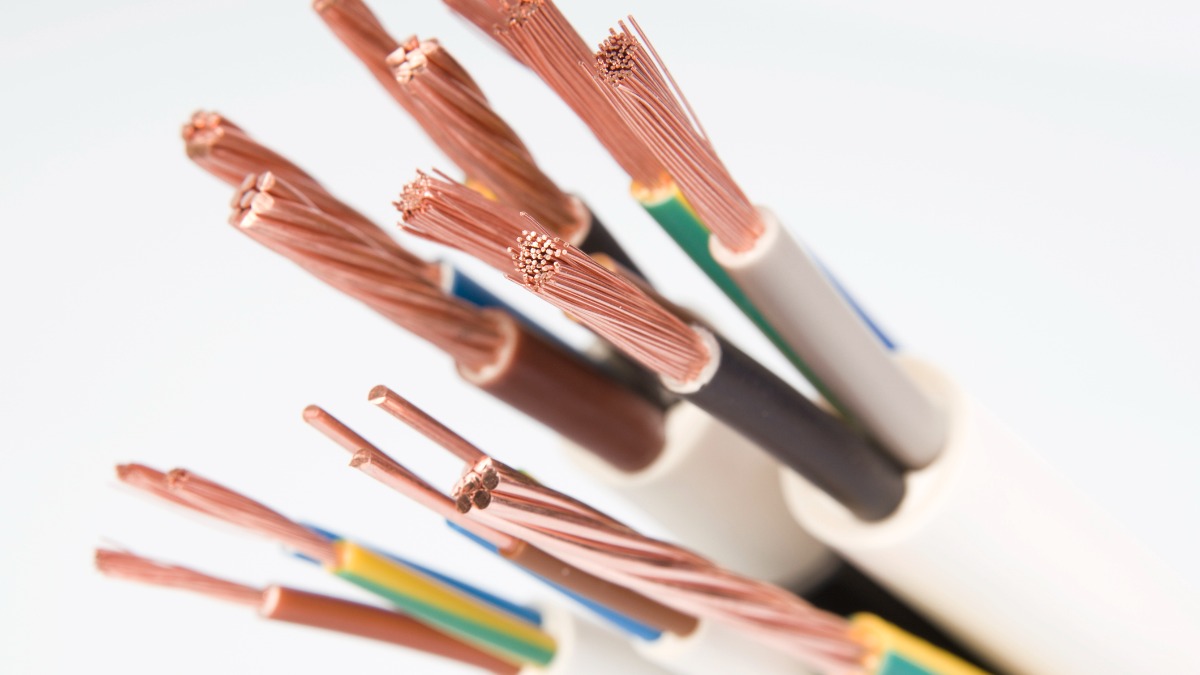

“Copper and aluminium are the principal materials for the manufacture of cables and lines.

“China’s power industry accounts around a third of the country’s total copper demand. This is likely to rise amid strong growth in grid infrastructure development to facilitate renewable energy and to protect the power system from surges in demand.

“The rise in investment in long-range power lines should benefit aluminium, and we expect to see the share of aluminium demand from the electricity sector rise to just under 20% by 2030.”

EV growth ‘blip’

Driving the positivity around future copper demand is not just renewables and transmission infrastructure.

Hynes and Kumari say the passenger EV market in China will grow 21% this year to 9.9m units, led by price cuts from major producers.

READ: XOXO: Lithium boss says Gossip Twirl hurting confidence in battery metals

US sales growth has slowed, but ANZ views this as a blip if current policy settings are unchanged (a key consideration in an election year), with EVs expected to account for a third of new car sales in 2027 against just 10% last year.

European EV market growth is also likely to be slow until stricter CO2 targets in the EU come in next year, but ANZ is the latest forecaster to suggest data centres will boost copper demand.

“Demand from the technology sector is also playing its part. Data centres consumed 460TWh in 2022, according to the IEA. This represented around 2% of all global electricity usage,” Hynes and Kumari said.

“The group says this could rise to more than 1,000TWh by 2026 in a worst-case scenario.

“In the US, which is home to 33% of the world’s data centres, consumption is expected to rise from 200TWh in 2022 to 260TWh in 2026, some 6% of all power use across the country.”

But the real steam will be generated in China and India.

“With the focus on energy security and the acceleration in the electrification of its economy, we see China’s demand for copper rising strongly over the next few years,” Hynes and Kumari wrote.

“We forecast annual growth rates of 6–8% between now and the end of the decade.”

ANZ previously forecast 2030 copper demand of 35.1Mt, with Indian demand to rise from 1.2Mt last year to 2.5Mt in 2030 (and 3.5Mt if it matches China’s 2000s growth trajectory) as it aims to increase renewable capacity by 500GW.

Bannerman sees strong support for uranium plays

It was smashed due to the discount, but Bannerman Energy (ASX:BMN) demonstrated the enthusiasm that abounds for uranium stocks right now by securing $85 million in a capital raising ahead of an FID on its Etango-8 project in Namibia.

The ~$500 million firm announced it was raising the cash via the placement of 25.8m shares at $3.30, a 7.8% discount to its previously closing price and 10.6% discount to its five day VWAP of $3.69 up to Tuesday.

Coming hot on the heels of the announcement of a potential multi-billion dollar merger between Paladin Energy (ASX:PDN) and Toronto-listed Fission Uranium, it demonstrates the corporate interest in the uranium sector with yellowcake prices in excess of US$80/lb.

That’s above the level generally considered strong enough to incentivise new sources of production.

It’s not the last time Bannerman will have to head to the market if it approves Etango-8, which carries a capex estimate of around US$353m.

All in sustaining costs for the ~3.5Mlbpa operation would come in at around US$39/lb, against May long term prices of ~US$77/lb.

BMN exec chair Brandon Munro said the placement will help secure long-lead items and market the Etango-8 product, with an FID targeted in the second half of 2024.

The stock was down 8.7% today, but is sitting on a 111% gain over the past 12 months.

The broader materials sector fell to a near 1% loss, with lithium stocks leading the drops. Energy was brighter, with Yancoal Australia (ASX:YAL) up over 3% as a selldown by a big Chinese holder gave minorities hope higher liquidity will enable access to the ASX 200 index.

Gold developer De Grey Mining (ASX:DEG) was also up over 4.5% after announcing a $1.13 billion finance package for its flagship Hemi gold mine at the same time as The Australian reported M&A interest in the project from Canadian giant Agnico Eagle.

Silex Systems (ASX:SLX), which has a partnership with Canadian uranium beast Cameco to enrich uranium for nuclear utilities in the United States, rose over 5% as the US Department of Energy committed to buy up to US$2.7bn of domestic enriched uranium as it became available in a bid to reduce reliance on dominant supplier Russia.

Today’s Best Miners

WA1 Resources (ASX:WA1) (niobium) +7.8%

Silex Systems (ASX:SLX) (uranium) +5.1%

De Grey Mining (ASX:DEG) (gold) +4.6%

Yancoal Australia (ASX:YAL) (coal) +3.4%

Today’s Worst Miners

Pilbara Minerals (ASX:PLS) (lithium) -5.8%

Arcadium Lithium (ASX:LTM) (lithium) -4.8%

IGO (ASX:IGO) (lithium/nickel) -3.9%

Mineral Resources (ASX:MIN) (lithium/iron ore/mining services) -3.6%

At Stockhead, we tell it like it is. While De Grey Mining was a Stockhead advertiser at the time of writing, it did not sponsor this article.

The post Monsters of Rock: Banks up copper demand forecasts on China’s hunger for power appeared first on Stockhead.