ASX 200 set to open higher on Monday as Wall Street posted gains

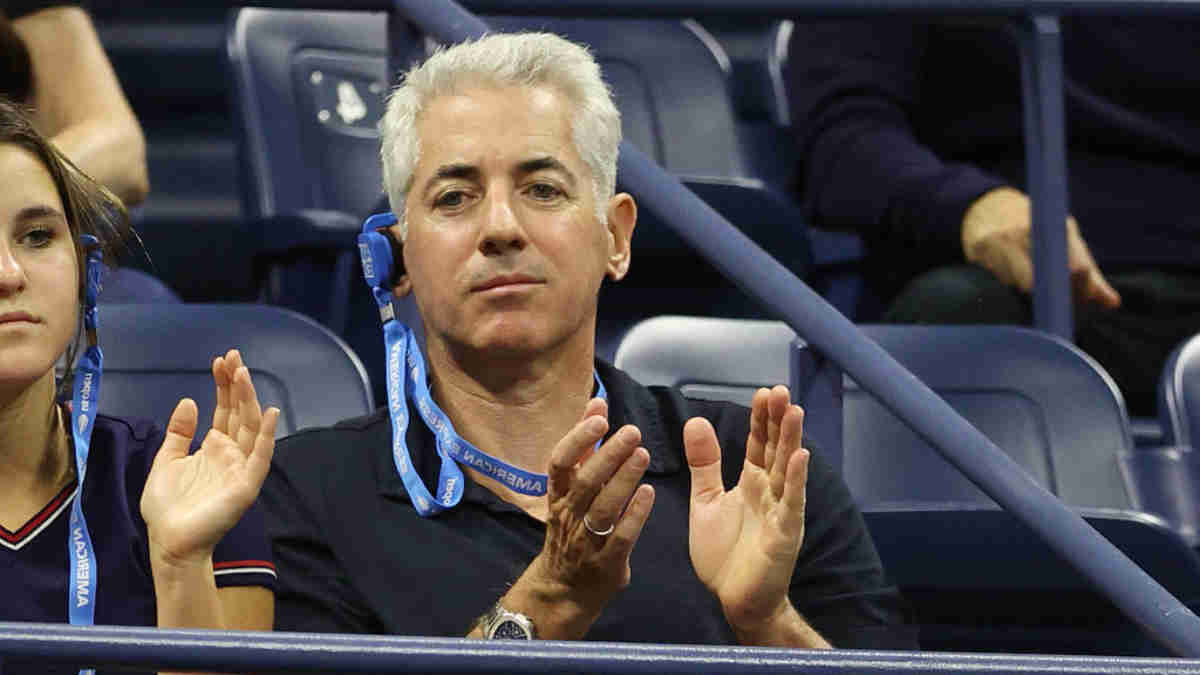

Bill Ackman is considering an IPO for his investment firm, Pershing Square

Indian stocks, bonds, rupee expected to rise as Modi’s party likely to secure win

The ASX 200 is poised to start the month higher when the market opens on Monday. At 8am AEST, the ASX200 futures contract was pointing up by +0.5%.

On Friday, the S&P 500 rose by +0.5%, the blue chips Dow Jones index was up by +1.51%, and the tech-heavy Nasdaq closed flat.

The month of May marked the sixth month out of the last seven where all three main US indexes finished higher, with all of them hitting new records during the month.

The S&P and Nasdaq had their best May performances since 2003, while the Dow had its best May since 2020.

To stocks, Trump Media & Technology fell -5% after Donald Trump was convicted on all 34 charges.

Dell Technologies plunged -18% as its AI server sales fell short of estimates.

The hotel and casino company, Caesars, shot up over 11% after news broke from Bloomberg that the investor Carl Icahn has bought a big chunk of the company. Last month, Caesars didn’t meet expectations for its Q1 earnings.

Retailer stock Gap surged over 28% after announcing impressive Q1 earnings and sales growth across all four of its brands.

Hedge fund manager Bill Ackman is reportedly contemplating the possibility of taking his investment firm, Pershing Square, to an IPO listing. Ackman aims to capitalise on his increasing social media influence.

The valuation of the firm is estimated to be around US$10.5 billion, with Pershing managing over US$16 billion in assets as of the end of April.

Meanwhile, bets are increasing that the Fed Reserve might cut interest rates in September.

This expectation is based on the latest core April PCE (Personal Consumption Expenditures) reading released on Friday, which indicates that price pressures have eased compared to the previous month. The PCE measure, which excludes food and energy costs, is closely monitored by the Fed.

“There is a disinflationary trend that is well in place,” Kristina Hooper at Invesco told Yahoo Finance after the PCE print. “It is very, very possible we get a July cut, if not July, September.”

Landslide for Modi?

Indian stocks, bonds, and the rupee are expected to climb on Monday after exit polls showed a big win for Prime Minister Narendra Modi’s party in the general elections that just concluded on Saturday.

The polls indicate that the Bharatiya Janata Party (BJP)-led alliance will get way more seats than needed for a majority in the lower house of parliament.

The predictions are expected to reassure investors who’ve been worried about recent ups and downs in the Indian stock market.

There were concerns that the BJP might not reach Modi’s goal of 400 seats because of low voter turnout and close races in some states.

But if they do win by a landslide, it means Modi can implement policies that are critical for India’s economy to keep growing, which is already one of the fastest-growing in the world.

In other markets …

Gold price fell by -0.7% to US$2,325.70 an ounce.

Oil prices retreated by a further -0.3%, with Brent crude now trading at US$81.13 a barrel.

The benchmark 10-year US Treasury yield was down a further 5 basis points (bond prices higher) to 4.50% on the weak PCE print.

The Aussie dollar rose by +0.3% to 66.55 cents.

The iron ore price dropped -0.4% to US$115.15 a tonne.

Bitcoin meanwhile rose by +0.1% in the last 24 hours to US$67,820, while Ethereum was down around -0.9% to US$3,785.

5 ASX small caps to watch today

Nuix (ASX:NXL)

Nuix said that based on the receipt of funds relating to an insurance claim made for non-operational legal costs associated with litigation, it now expects that Statutory EBITDA for the full year FY24 is likely to be in the range of $55-$60 million. This compares to the range of $47-$52 million which was previously announced on 20 May. Nuix expects that Underlying EBITDA, which excludes non-operational legal costs, is likely to be unchanged in the range of $63-$68 million for FY24 as also announced on 20 May.

Infini Resources (ASX:I88)

Infini announced the strategic consolidation of its Yeelirrie North Uranium Project via the successful purchase of the Bellah Bore East Uranium Project in WA. The project is located adjacent to Cameco’s Yeelirrie North Uranium Project. Terms of the acquisition comprise of a cash payment to the seller of $47,500 + 1% net smelter royalty.

Marmota (ASX:MEU)

Marmota announced that it has completed the design of the drill program for the Yolanda area at its 100% owned Junction Dam Uranium Project immediately adjacent to Boss Energy’s Honeymoon Uranium Mine. Yolanda is located to the south of Marmota’s Saffron Uranium resource area at Junction Dam. The Yolanda uranium exploration target is over 8km long and more than 1km wide. It features high-grade uranium mineralisation, with 75 drill holes having been planned over the area.

Vulcan Energy (ASX:VUL)

Vulcan Energy announced strategic investments totaling €40 million (~$65 million) from CIMIC Group, Hancock Prospecting, and Victor Smorgon Group. These investments, made through private placements, show strong support from strategic investors for Vulcan’s lithium value chain and the development of Phase One of its renewable energy and ZERO CARBON LITHIUM Project in Germany.

BetMakers Tech (ASX:BET)

Betmakers has announced two-year agreements with bet365 for access to markets and content in New Jersey and Colorado. These agreements allow bet365 to offer fixed odds bets on horse racing in New Jersey and to provide BetMakers’ horse racing content to its customers in New Jersey and Colorado. BetMakers will receive fees from bet365 based on the bets placed by customers in New Jersey and Colorado.

The post Market Highlights: ASX to rise, Bill Ackman mulls IPO, and Modi set for landslide win appeared first on Stockhead.