Fortescue knocks down guidance again at Iron Bridge as issues with a leaking water pipeline persist

But its realisations for low grade iron ore were strong, collecting 91% of the benchmark as it shipped 48.7Mt of hematite in the December quarter

Fortescue (ASX:FMG), which has defied the incredulity of market analysts to hit all time highs early this year, has continued to knock down guidance from its US$4 billion Iron Bridge magnetite mine.

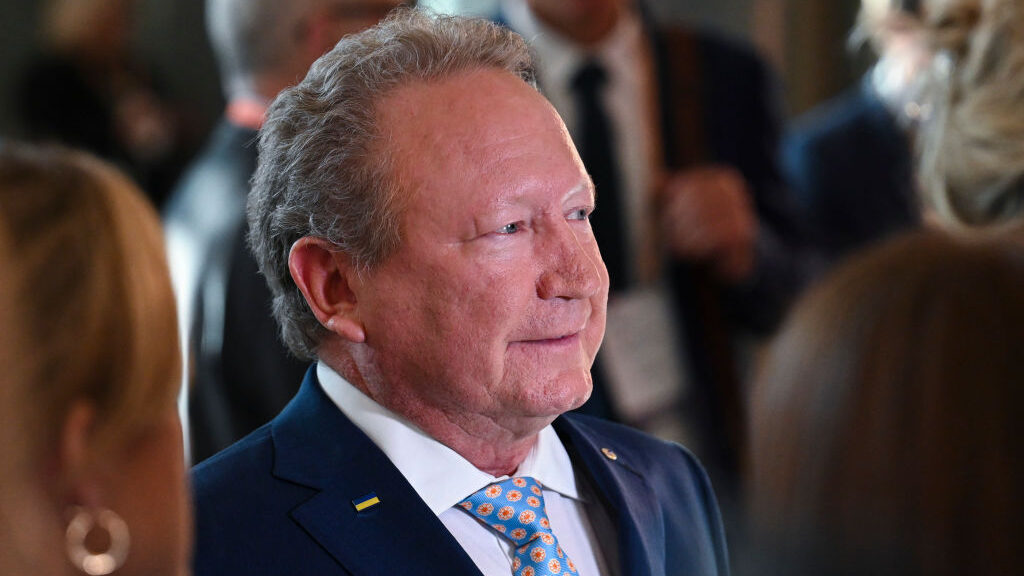

The new operation, a high grade development designed as an in to the green steel industry and counterweight to Andrew Forrest’s well-worn low grade hematite business, was long overdue and over budget.

The timing of its ramp up to its full run rate of 22Mtpa, expected in late 2025, now seems to be threatened with guidance for this financial year scaled back from 5Mt to 2-4Mt after issues with a leaking raw water pipeline which will require FMG to spend US$100m to rectify.

While FMG says the work to rectify the issue won’t impact the ramp up timeline, magnetite operations in Australia have historically taken longer than expected to hit their straps.

Fortescue said it made a second concentrate shipment from Iron Bridge in the December quarter and three this month as commissioning ramps up, selling its product at a 4% premium to the 65% Platts iron ore index for US$144/dmt.

The mine produces a 67%+ Fe concentrate which could be used in low emissions steelmaking or as blending material with the same low grade iron ore FMG produces at its other Pilbara mines.

The iron ore-cum-green energy proponent was rosy on that front. While shipments for the first half fell 2% (94.6Mt) after shipping 48.7Mt in the December quarter, the real success was on price realisations.

With steelmakers in China struggling to remain profitable amid low demand and high raw material prices, discounts have narrowed with FMG pulling in 91% of the Platts 62% Fe index at US$116/dmt.

That came against C1 cash costs of US$17.62/wmt, down 2% on the quarter, while an iron ore derailment shortly before New Year’s looks to have had limited impact with rail operations restarting on January 3.

FMG has boasted costs of US$17.93/wmt so far this half year, up on costs at the same period last year but below its US$18-19/t guidance.

All quiet on the green front

The $87 billion miner’s diversification plans have been well telegraphed, with announcements on a string of green energy projects and the first shipment of iron ore from the Belinga project in Gabon (only 11,000t worth though) occurring during the quarter.

They include an FID on hydrogen projects in Phoenix and Gladstone and a US$50m green iron trial plant at the Christmas Creek mine.

FMG also said three projects in Kenya, Brazil and Norway, the latter a green ammonia site subject to a €204m grant from the EU, had been ‘fast-tracked’, though it made no new announcements today on their delivery timeframe.

It also announced a US$35m investment into a hub in Michigan to produce new energy tech including hydrogen generators, fast chargers and electrolysers.

Fortescue’s iron ore winnings saw the market giant up its cash balance from US$3.1b to US$4.7 billion during the quarter, cutting net debt to US$0.6b, with US$1.5b spent on capex for half and US$759m in the quarter.

Forecasts for capex in FY24 include US$2.8-3.2b in the metals division with US$800m in opex and US$500m in capex and investments guided for its energy business.

FMG Metals CEO Dino Otranto said the company continued to ‘deliver strong operational performance’ while touting ‘tangible progress’ on ‘ambitious’ decarbonisation and green energy targets.

“Our decarbonisation plan is progressing well with the first of an initial three electric excavators now operational in the Pilbara. Powered by a 6.6kV substation and more than two kilometres of high voltage trailing cable, this electric excavator is the first of its kind in Australia for the mining industry,” he said.

“Further supporting our commitment to eliminating emissions was the announcement of construction of a Green Iron Trial Commercial Plant at our Christmas Creek mine site. This facility will produce green iron using the existing green hydrogen already being produced at site, marking a significant milestone in Fortescue’s green iron strategy.

“Demand for Fortescue’s suite of iron ore products remains strong and our entry into the higher grade segment of the market through Iron Bridge has been well received with our second magnetite shipment during the quarter. This is further supported by the Belinga Project in Gabon where we shipped our first product in December.

“Our energy business marked a significant milestone, with final investment decisions announced for green hydrogen projects in Australia and the USA. This reflected our disciplined approach to capital allocation and clear intention to learn prior to committing to large scale investments.”

FMG spent US$62m on exploration and studies in the December quarter, including iron ore exploration to define resources at its Mindy South and Wyloo North deposits and in Belinga, while it is drilling for copper in Queensland, South Australia, Peru and Chile and rare earths in Brazil.

Shares in FMG lifted 2.54% in early trade, with Chinese stimulus hopes sending iron ore prices up 3% to almost US$136/t yesterday.

Fortescue (ASX:FMG) share price today

The post FMG Results: Iron Bridge ramp up continues to stutter but the tried and tested works wonders for FMG appeared first on Stockhead.

+ There are no comments

Add yours