Local markets opened higher this morning – not by a lot, mind you, but enough to put a spring in the step of investors, particularly those that have their money in with the goldies, which were charging hard in early trade.

It’s not all fabulous news – and I’ll get to the cruddy bits in a minute – but first, to a story about crypto that is just too priceless to ignore.

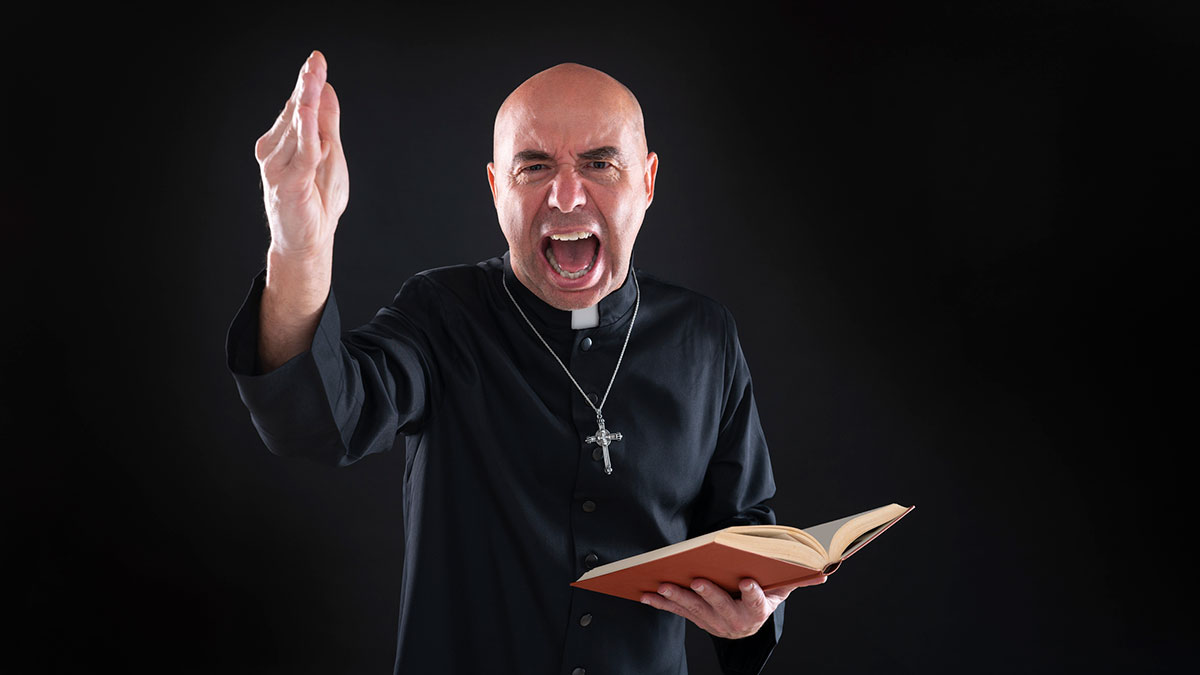

It’s often been said that “The Lord moves in mysterious ways”, so it should come as absolutely no surprise to anyone that God has, apparently, decided it’s time to branch out into crypto.

That’s the message we’re hearing from Eligo Regalado, the pastor of a Colorado-based online church, who is currently in nine different kinds of hot water with that state’s Securities Commission over what looks suspiciously like a multi-million dollar sh.tcoin scam.

Brace yourself, because here comes the stoopid.

Regalado and his wife Kaitlyn told their church followers that God himself told him to mint himself a sh.tcoin and, despite having precisely zero prior experience in the area, set up an exchange to provide a place for church faithful to – at their trustworthy pastor’s insistence – buy an alarmingly large quantity of it.

The divine order from on high resulted in Regalado building the Kingdom Wealth Exchange, which was the only exchange selling the in-house, God-approved INDX token – which Colorado authorities have, quite blasphemously, called “illiquid and practically worthless”.

All up, Regalado and his missus managed to fleece his flock out of US$1.3 million – which the good pastor has freely admitted to – and, now that investigators have filed civil charges against him for breaking all manner of rules, he’s taken a rather extraordinary step of throwing God Himself under the bus to take the blame.

In a video statement to the faithful, Regaldo patiently explained that the couple “took God at His word and sold a cryptocurrency with no clear exit”.

And, if you’re not already pounding your head against the desk in frustration at how achingly stupid this sounds, it gets better.

“I’m like, ‘well, where’s this liquidity going to come from,’ and the Lord says, ‘Trust Me’” Regalado said in the video.

“We were just always under the impression that God was going to provide that the source was never-ending.”

Sadly for Regaldo, it looks like God understands crypto about as well as I do – and He’s being used as the patsy, now that the scheme has unravelled and His messenger is deep in the crypto doo-doo with regulators.

The cherry on the top of this outburst of gross stupidity is that Regaldo appears to be, like all good crypto shonks before him, doubling down on the value of God’s sh.tcoin.

He’s promised to appear in court and fight the allegations against him, and tried to reassure those good Christian people who bought into the scheme that they just have to keep the faith.

“God is not done with this project; God is not done with INDX coin,” he said, showing an unnerving level of calm because that’s precisely the kinda talk that gets people smited.

TO MARKETS

Aussie markets got off to a positive start this morning, with the benchmark climbing to 7,540 (+0.3%) in a matter of minutes, before it ran out of puff and chugged slowly back down towards flatline. By the time we were unwrapping our sandwiches, the benchmark had dipped to -0.1% and was trending ever-lower.

For once, it’s not the Materials sector dragging its feet – today’s dose of the doldrums is proudly brought to you by the local InfoTech sector, which is down close to 1.4% mid-morning, with Health Care in distant pursuit on -0.66% so far.

The Materials sector is, in fact, having a banger this morning – up 1.4% before retreating a little, with the good news coming especially from among the goldies which are surging like a king tide through the streets of Venice.

Chart via Marketindex.com.au

The XGD All Ords Gold Index is up 2.78% mid-morning, despite gold prices softening a little over the past 24 hours to be down around the US$2,027/oz mark.

Chart via Marketindex.com.au

The main reason why local investors have got a case of the wait-and-sees this morning is that we’re all on tenterhooks before Albo fronts the cameras in Canberra to tell us what kind of mischief his government’s been up to, during a revisit of the Stage 3 tax cuts, which are due to come into force from July 1.

There’s quite a lot of shouting from the sidelines on the issue – most notably from those who want the tax cuts to go ahead as promised, given that it’s a policy that’s been tested at the ballot box twice, and one that Labor pinky-promised to stick to if it won government.

But, here we are – surrounded by markets around the world that are leaping from record high to record high, while ours wavers in the face of a government that can’t help but tinker with stuff when it clearly said it wouldn’t.

In Case You Missed It: AM Edition

A few items from the ASX announcements list that might have slipped beneath your radar this morning include one from Viridis Mining and Minerals (ASX:VMM), which has signed two binding agreements to secure an additional 101km2 of additional mining rights alongside its currently held licences at the Poços De Caldas Alkaline Complex, Minas Gerais, Brazil.

Ionic Rare Earths (ASX:IXR) has had some movement in the boardroom, with former Sayona Mining (ASX:SYA) managing director Simon Lynch stepping into the role of executive chairman, effective today, bringing with him more than 30 years’ worth of experience in international business development and management.

Fatfish Group (ASX:FFG) has a new recruit to brag about as well, following the appointment of Rhys Campbell as the company’s new senior director of Social Gaming. Campbell’s got form in that market sector – he was VP of Engineering at global social gaming company Virtual Gaming Worlds, overseeing growth and development of the engineering department at a time when that company delivered financial year revenues of A$4.3 billion.

And briefly, Besra Gold (ASX:BEZ) would like everyone to know that it’s been shopping, and snapped up 1,802 shares in North Borneo Gold (NBG), the owner of the Bau gold project, from Gladioli Enterprises for a cool half-million dollars. The purchase pushes Besra’s ownership of NBG up by 0.72% to 98.5%, which – on an equity adjusted basis – represents an increase in Besra’s interest in Bau of 0.78% to 93.55%.

Happy days.

NOT THE ASX

Wall Street, much like the Menulog guy who recently binned his scooter out the front of my place in spectacular fashion, delivered a mixed bag last night.

The S&P 500 rose 0.29% and set a record for the third consecutive day, the Nasdaq got all AI-happy again and put on +0.43%, but the stuffy old Dow retreated -0.25% because it just doesn’t understand all these new-fangled computers with all their silicon chips and such.

Earlybird Eddy reported that earnings season has gone into full swing in New York, with United Airlines, Verizon and Procter & Gamble all rising after providing upbeat results.

It wasn’t all good news, though – 3M collapsed by -11% after its outlook for 2024 fell way below expectations, despite a noted increase in the number of packets of Post-its missing from the nation’s stationary cupboards.

And Johnson & Johnson also fell almost 2% as the company narrowly topped quarterly estimates, amid a rash of consumer claims that the company’s ‘No More Tears’ shampoo is not an effective treatment for depression, no matter how many bottles of it you drink.

All eyes will be on Wall Street over the coming days as the so-called Magnificent 7 deliver their earnings in the coming days.

In Asian market news, Japan’s Nikkei is powering ahead full throttle this week, smashing through the 36,000-point mark to hit highs we haven’t seen since The B52’s Love Shack was at the top of the charts.

Japan weathered an appallingly difficult start to 2024, with an earthquake and air disaster knocking the gloss right off the new year early on, while the usual parade of irradiated monsters took turns laying waste to the city of Tokyo, just to keep everyone on their toes.

Today, the Nikkei has retreated a little throughout the morning, down 0.45% so far.

In China, word on the street is that central authorities are getting ready to arm the populace with wheelbarrows and shovels, in preparation for a fresh round of stimmies – rumoured to be in the vicinity of 2 trillion yuan (roughly $431 billion Aussie dollarydoos) – designed to stabilise markets there.

It’s a lot of money, sure… but the problem with Chinese stimulus packages is that they taste great while you’re receiving them, but 45 minutes later you’re broke again.

Today, Hong Kong markets are up 2.23%, while in Shanghai things are climbing more sedately, up 0.81% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 24 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Newmark Property REIT is charging hard at the top of the Small Caps ladder this morning, up more than 38% on news that it has entered into a Bid Implementation Deed that will see BWP Management lock in an off-market, 100% takeover, as part of an a proposed all-scrip merger between the pair.

It’s an almost-impossible to turn down transaction, with BWP happy to cough up 0.40 BWP units per NPR security, to meet an implied value of $1.39 per NPR security – which is a thunderous 43.1% premium to its closing price yesterday at $0.97 a pop.

Meanwhile, Surefire Resources (ASX:SRN) has hit a home run in the lab, with the company claiming a breakthrough pre-treatment and leach process that has allowed it to extract 91% of vanadium and 88% of titanium directly from Victory Bore magnetite concentrate.

It’s big news for Surefire, and stems from the company’s strategy of teaming up with METS Engineering in May last year, specifically to look into developing a better method of extraction, specifically for vanadium – as it appears that the ”unexpected extraction” of titanium during the process is a surprise bonus for the team.

The process is, as you’d expect, commercial in confidence – so, the specifics aren’t going to be made public just yet – and Surefire says it is subject to a Provisional Patent protection and remains solely the company’s IP.

Market minnow Eden Innovations (ASX:EDE) has banked a 33.3% jump this morning on the heels of a positive quarterly, which talked up “interest from a large multi-national company” in the company’s patented, core pyrolysis tech to make hydrogen and carbon nanotubes from natural gas without all that pesky CO2 as a by-product.

Eden reports that revenue for December quarter for its EdenCrete product is up 8% on PCP, however sales of its OptiBlend have fallen dramatically, down -93% – with a caveat that there are some significant sales negotiations underway in India at the moment.

And online retailer Harris Technology (ASX:HT8) has dropped its quarterly this morning, with the news that it has generated sales revenue of $4.9m through the December quarter, with thanks to an “increased contribution from the Household and Seasonal categories in line with the busy retail season through Black Friday, Christmas and Boxing Day”.

That was enough to drive a net operating cash inflow of $235,000 for the quarter, marking the second consecutive quarter and just pipping the previous three-month result of $226,000.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 24 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

The post ASX Small Caps Lunch Wrap: Who’s claiming God told them to mint a sh–tcoin this week? appeared first on Stockhead.

+ There are no comments

Add yours