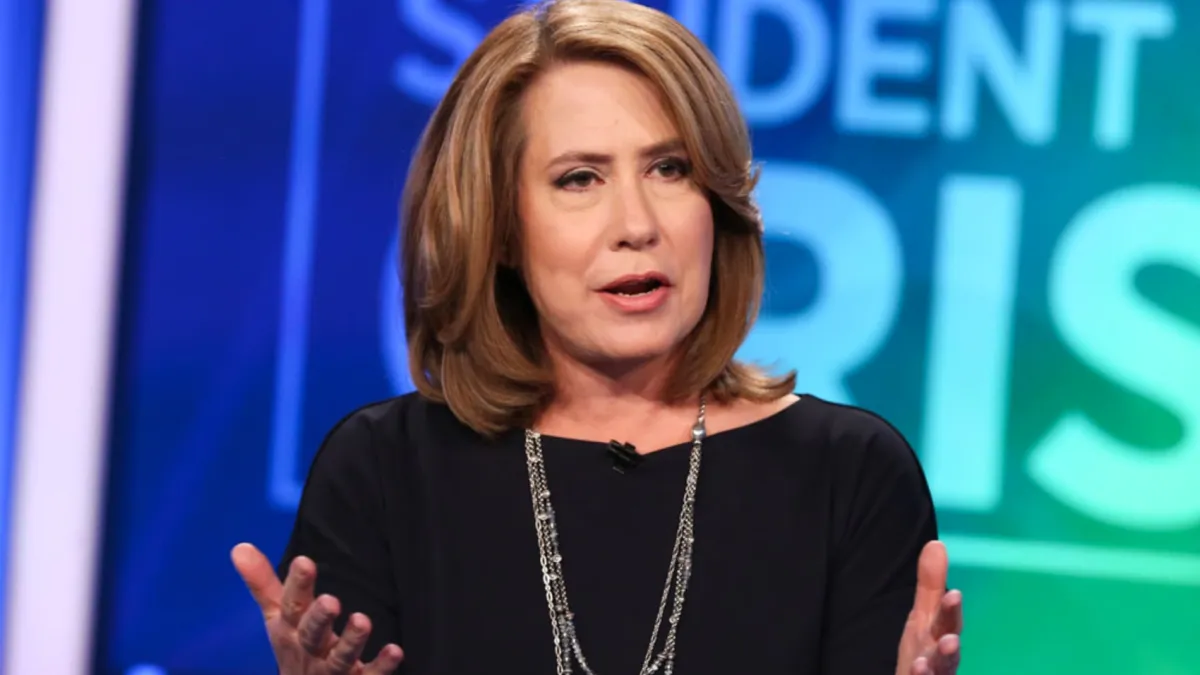

As regional banks prepare to unveil their quarterly earnings, concerns loom about potential vulnerabilities within the sector. Sheila Bair, the former U.S. Federal Deposit Insurance Corp (FDIC) chair, has voiced significant worries that these institutions may still grapple with unresolved issues from the previous year. Her insights from steering the FDIC through the 2008 financial crisis offer a critical perspective on these banks’ potential challenges today.

Sheila Bair’s comments during her appearance on CNBC’s “Fast Money” highlighted a range of problems that could be revealed as regional banks report their earnings. “I’m worried about a handful of them,” Bair expressed, pointing out that “some of them are still overly reliant on industry deposits, have a lot of concentrated commercial real estate exposure, and then I think the larger picture is the potential instability of their uninsured deposits even for the healthy ones if we have another bank failure.”

The current financial performance of regional banks amplifies her concerns. The SPDR S&P Regional Bank ETF (KRE), which tracks this sector, is down nearly 13% this year, with only four members showing a positive trajectory for 2024. Notably, New York Community Bancorp has drastically declined, plummeting more than 71%. Metropolitan Bank Holding Corp., Kearny Financial, Columbia Banking System, and Valley National Bancorp have also suffered significant losses.

Bair argues for a proactive approach to mitigate these risks. “Congress should reinstate the FDIC’s transaction account guarantee authority so that they can stabilize those deposits,” she recommended, underscoring the gravity of the situation. The instability of the banking sector, exacerbated by a sharp increase in the 10-year Treasury note yield to its highest since November 2023, adds another layer of complexity, particularly for commercial real estate borrowers who face higher rates on refinancing.

As the regional banking sector navigates these turbulent waters, the fallout could redistribute market dynamics, benefiting larger financial institutions. “Regional bank distress benefits the big money-center banks. There’s no doubt in my mind,” Bair concluded. Her insights serve as a critical warning that the financial health of these smaller banks could have broader implications for the economy and require immediate and strategic responses to stabilize and secure their futures.