Market analysts believe EL8 is a uranium story with a difference

Three drill rigs are on the go at Koppies to move 50% of the resource to the higher confidence indicated status

Another two rigs are drilling at Hirabeb and Capri

Special Report: Strengthening uranium prices might be providing relief for current producers and hope for aspiring developers, but many projects are still marginal at best.

It takes a whole lot more than just price hikes for projects to get up and running. Things like bureaucracy, jurisdiction, community, permitting, environmental studies, construction, funding and financing all come into play.

And even with that all lined up at some advanced uranium developments, many analysts believe there won’t be a short to medium-term supply response that could derail the current supply deficit, which currently sees global demand reaching 209Mlb annually by 2035.

Supply will fall short at 114Mlb, a little over 54% of end user demand as contracts continue to be drawn with higher ceilings and floors.

Largest land position for nuclear fuels in Namibia

But there’s still a few companies out there like Elevate Uranium (ASX:EL8), who have caught the eyes of market analysts for being a ‘uranium story with a difference’.

EL8 has assembled the largest land position for nuclear fuels in Namibia, with its project portfolio including the 58Mlb Koppies asset as well as the 61Mlb Marenica uranium project in the Erongo region.

Namibia is Africa’s biggest uranium producer and the world’s third largest, with a long history of uranium mining dating back to 1928, when the metal was first discovered in the Namib Desert.

Yellowcake was eventually produced by Rio Tinto at the Rossing Mine in the mid 1970s, the longest running open pit uranium mine in the world, now 69% owned by China National Uranium Corporation alongside the Government of Iran, IDC of South Africa and the Government of Namibia.

The Erongo region itself has seen the development of another three uranium mines in the last 16 years, with Bannerman (ASX:BMN) and Deep Yellow (ASX:DYL) also receiving the grant for two mining licences at their respective projects in December last year.

From a jurisdictional point of view, Elevate Uranium managing director and CEO Murray Hill says Namibia is a great place to be.

“As well as the history with the development of uranium mines, there’s now a recent history of the issuing of mining licences,” he told Stockhead.

“It is a very supportive government, supportive community and is the only country in the world with a dedicated uranium association.

“For us, we are looking for shallow uranium deposits so the arid nature and near surface mineralisation makes it ripe for that.”

Three drill rigs on the go at Koppies

Around 50% of the ore at EL8’s flagship Koppies project is within 7m of surface making it inexpensive for exploration and mining .

Three drill rigs are currently on the go at the site, working on indicated resource drilling programs targeting to get at least 50% of the resource within the higher confidence ‘indicated’ status.

Unique U-pgradeTM process

In addition to maintaining prospective uranium acreage and resources within Namibia, EL8 also retains a potentially ground-breaking technology that could radically improve the commerciality of calcrete-hosted uranium deposits.

EL8’s U-pgradeTM process has the capacity to lower the operating cost-base specifically for shallow secondary uranium deposits, thereby improving operating margins, profitability and commerciality.

The beneficiation process, developed on ore from the Marenica project, rejects greater than 95% of the mass of uranium ore through removal of non-uranium bearing minerals.

“The rejection of the bulk of the mass through the U-pgradeTM process is expected to lower both the capital and operating costs by 50% compared to conventional processing.”

“The generation of a low mass high grade concentrate from U-pgradeTM also provides EL8 with development options for their uranium projects, further improving the commerciality.”

EL8 recently excavated test pits at Koppies to generate samples for metallurgical testwork using EL8’s proprietary U-pgradeTM process.

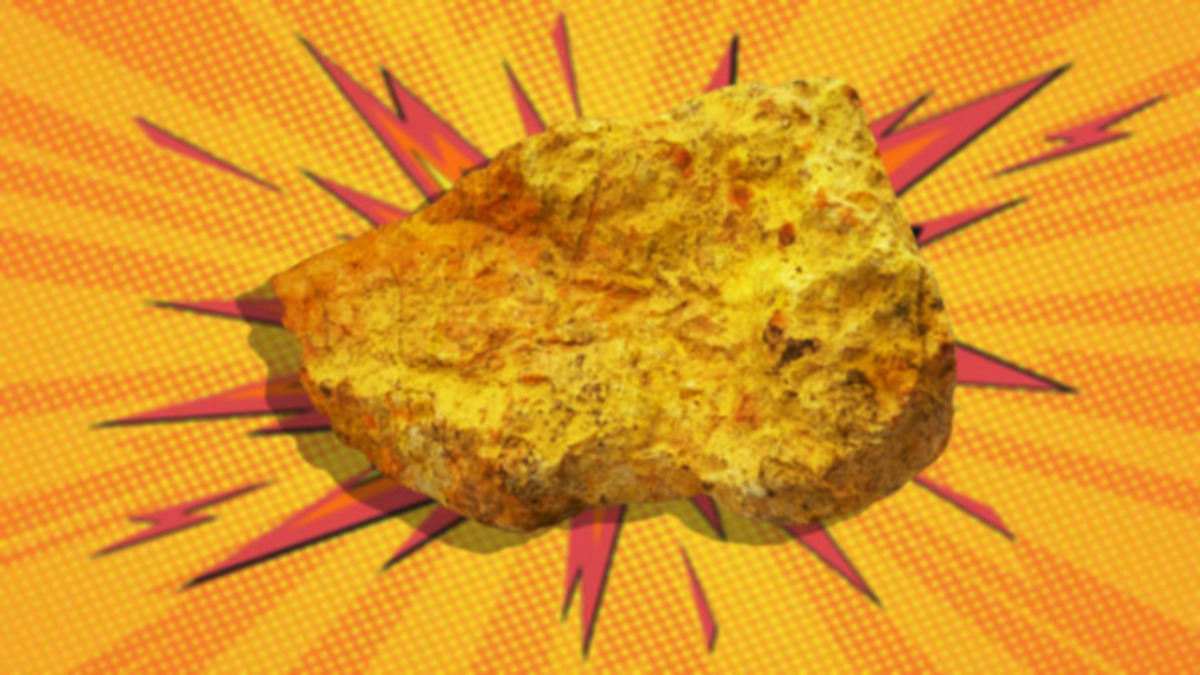

“As a metallurgist by trade, what excites me the most about Koppies is how you can see the uranium mineralisation on the surface of the rocks,” he says.

“The mineralisation isn’t sitting within the rocks which means it will be very easy to concentrate through our U-pgradeTM process, and we think that process is going to make a big difference to the financial metrics of the project.”

“We expect to confirm this through the bench scale metallurgical program to commence shortly and confirm the viability of U-pgradeTM in a pilot plant expected to be operated in 2025.”

Bright yellow carnotite mineral is clearly visible in the mineralisation from the basement test pits. Pic: Elevate Uranium

According to MineLife founder and mining analyst Gavin Wendt, this is what makes the company unique.

“EL8’s strategy is to appraise and commercialise its properties that are prospective for calcrete-hosted uranium mineralisation, which allows it to target areas containing paleochannels that drain bedrock granites, the source of the uranium in the known calcrete deposits,” he says.

“These areas have had very little modern exploration.”

Drilling for maiden resources at Hirabeb and Capri

Hill says another two drill rigs are on the go at the Hirabeb and Capri projects where programs are working towards delineating a maiden resource.

“We’re probably one of the most active uranium exploration companies on the ASX, we’ve got five drill rigs working with over 125 holes drilled per week,” he says.

“We’ve made four discoveries in four years and are heading down the maiden resource path at both Hirabeb and Capri.

“It’s an exciting time, hopefully we can find some more uranium discoveries across our large tenement position in the country.”

With a market cap of $128m, Elevate shares were trading at 42c on July 15, a ~35% lift over the previous 12 months.

This article was developed in collaboration with Elevate Uranium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post EL8: A uranium story with a difference appeared first on Stockhead.