The cost of a cuppa is set to surge, with coffee and tea prices spiralling on global markets.

Wholesale coffee prices are up about 40% this year after harvests were hit by extreme weather in key producing countries, including Vietnam and Brazil, both the world’s top producers for both the world’s key crops – Robusta and Arabica.

The chart below shows the movement of the price of an espresso coffee at a popular café including any service charge between March 2023 and March 2024.

Buenos Aires and Istanbul are the capitals of crazy inflation, where costs for everything continue to spiral out of control…

At number #3 is Sydney, however…

Screenshot: Mercers

The problem for Sydney, and the rest of us is in Australian cities, is that after some scary rises it seems the cost of your latte or cap currently between $4.00 and $5.50 is actually, by international standards, pretty low.

Via The Conversation, March 28, 2024. Prices in AUD

Despite levelling off from post-pandemic highs, prices for tasty Arabica, which accounts for 75% of the world’s production, is still trending up.

In 2018, it sold for US$2.93 per kilogram, which is projected to increase to US$4.38 dollars in 2025.

Last week Bloomberg reported that Brazil’s key upcoming coffee crop is suddenly looking weak as water after the unwelcome heat and drought of the past several months produced a bunch of smaller beans, which is no good for a decent brew.

“There is certainly a concern about production shortfall,” Simão Pedro Lima, an executive at cooperative Expocacer told Bloomers.

While the full impact of what these teeny beans will have on global markets is yet to be quantified, the concern is already spurring some downward revisions for production estimates of Arabica.

Arabica coffee by the way, is the world benchmark for coffee futures contracts that trade on the Inter Continental Exchange (ICE).

Arabica, is mostly cultivated in Brazil – 40% of the world’s total supply – and Colombia.

Robusta makes up the remaining 25% and is mostly produced in Vietnam – 15% of global supply – and on Indonesia. Other major exporters include Peru, India, Uganda, Ethiopia, Mexico and Cote I’voire.

Vietnam is copping its worst drought in almost 10 years, and the likely impact on its coming harvest is not going to be positive.

Coffee costs for drinkers around the world are likely to rise.

While record wholesale prices have so far had a limited impact on consumer prices, there are signs that might be changing.

Recent data from Eurostat showed coffee inflation up by 1.6% in the European Union in April and 2.5% in robusta-loving Italy.

That’s still well below price rises from a year earlier, but it was higher than 1% in the March EU reading – a sign roasters may have started to pass their higher costs on to consumers.

Arabica futures are on pace for a fourth straight monthly gain and have climbed about 20% this year on supply concerns.

With ‘Nam’s ongoing drought, Robusta prices are up more than 40%, YTD.

According to Reuters, major US brand-owner J.M. Smucker Co. is set to hike prices.

Elsewhere, tea costs have jumped by more than a third during April-May – and that alone was due to rising industry costs and the Red Sea crisis affecting container-ship movements.

Experts are forecasting a continuing decline in production, demonstrating how these beans affect everything from our lattes to the broader financial landscape

Hedge funds and other speculators have piled into bets on Arabica prices rising, according to the US Commodity Futures Trading Commission.

This has also pushed arabica prices higher.

The rising price of coffee comes as other soft commodities surge. Cocoa futures surpassed a record $10,000 per ton at the end of last month, and are nearly four times higher than a year ago.

According to the Financial Times, this is becoming the new normal as climate change thwarts crop production.

These changes, along with new European regulations aimed at promoting sustainable agriculture, are stirring significant fluctuations in global coffee prices, which caught the attention of Dr Wei Hutchinson, an independent data scientist and quantitative researcher and led her to investigate how major corporations entrenched in the coffee industry are dealing with the fallout.

“To grasp the full impact of rising coffee prices, I analysed historical stock price data for five major coffee-related companies – Keurig Dr Pepper, Starbucks, J.M. Smucker, Luckin Coffee, and Nestlé – from 2021 to 2024.”

Dr Wei says this data was then paired with the commodity price movements of coffee over the same period.

Correlation: Coffee prices and major coffee stocks

Keurig Dr Pepper (KDP):

Exhibits a very high correlation with coffee prices (0.85) and relatively low volatility (3.05%). KDP’s stock shows substantial changes year over year during periods when coffee prices rise, suggesting direct impacts on its cost structure despite its diversified product lines.

Starbucks (SBUX):

With moderate volatility (3.91%) and a lower correlation (0.34), Starbucks experiences less dramatic year-over-year changes. Nonetheless, rising coffee prices have prompted strategic pricing adjustments to sustain profitability.

J.M. Smucker (SJM):

This company shows the lowest volatility (3.03%) yet a high correlation (0.63) with coffee prices, reflecting significant impacts on its profit margins during times of high volatility in coffee prices.

Luckin Coffee (LKNCY):

Despite extreme volatility (16.47%), Luckin Coffee shows minimal correlation to coffee prices (0.03), indicating that other operational or market-specific factors predominantly influence its stock performance.

Nestlé (NSRGY):

Demonstrates low volatility (2.31%) and moderate correlation (0.59), with its broad product diversification buffering against coffee price volatility, providing a stable financial outlook despite external fluctuations.

Luckin Coffee’s success is no surprise. Coffee is still a rising middle class luxury and Luckin has tapped into that very nicely amid a 130% rise in domestic coffee consumption. Thus going in fast for market share – executing an aggressive expansion strategy to more than 16,000 stores across the mainland.

I don’t drink tea

So… Whether you savour the robust aroma of coffee or prefer the soothing brew of tea, these beverages are inseparable from global trade.

Released on Friday, an S&P Global Market Intelligence report shows how quickly the global trade landscape is moving.

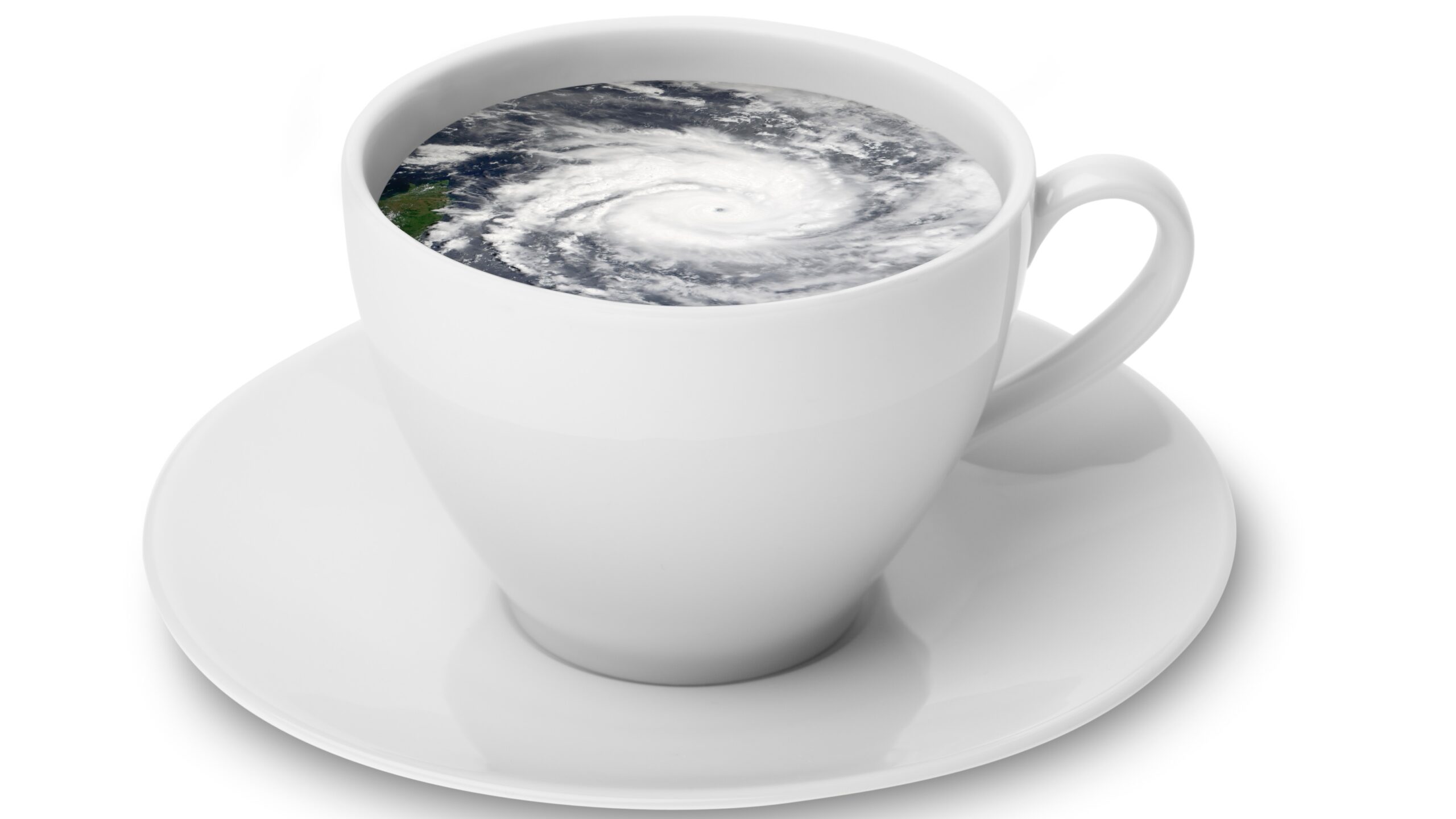

Demand in a tea cup:

In 2023, global coffee and tea trade volumes were 8.88 million metric tons (MMt) and 1.89 MMt, respectively.

Brazil, Vietnam, and Colombia were top primary (non-roasted) coffee exporters, while Kenya, mainland China and Sri Lanka led in tea exports.

Vietnam and Indonesia were the only countries in the top 10 for both coffee and tea exports. The US and Germany were among the top 10 importers for both.

Brazil was the global leader in the export of “coffee, not roasted, not decaffeinated” in 2023, accounting for almost one third of the global export volume.

The top 10 countries accounted for 84% of the total.

The United States led in coffee imports in 2023 with an 18% share. European countries in the top 10 collectively imported 42% of global coffee raw materials by volume, and Japan made up 5%, ranking 5th. Mainland China and South Korea ranked 11th and 12th, respectively.

Via S&P

The global top tea consumers and producers differ from the leading exporters

Mainland China, a global leader in tea production, exported 365,000 metric tons of tea in 2023, about 10% of its total production, while Kenya exported over 540,000 metric tons, more than its annual production

Tea contributed about 23% to Kenya’s total foreign exchange and 2% to its agricultural GDP

In 2040, coffee and tea trade are forecast to grow to 10.73 MMt and 2.14 MMt, respectively, at compound annual growth rates (CAGRs) of 1.1% and 0.7%, respectively, from 2023

When converted from metric tons to cups, the dominance of coffee becomes smaller: 1 kg of roasted coffee beans yields 111 cups, while 1 kg of tea leaves can produce up to 400 cups. In 2023, the world traded the equivalent of 986.0 billion cups of coffee and 757.9 billion cups of tea

By 2040, the numbers are expected to increase to 1.2 trillion coffee cups and 856.2 billion tea cups

The post Storm in a cuppa? Tea and coffee prices face demand, climate change and hedge funds appeared first on Stockhead.