Irate with the insurers? Ripped off by retailers? Bilked at the bowser?

Don’t just rant about the bloody insurers/bank/supermarkets/petrol companies and their (alleged) profiteering during the cost-of-living crisis. Seek constructive revenge by buying them instead.

On your columnist’s back-of-the-envelope sums, the listed companies most responsible for consumer pain have outperformed the market share-price wise, whilst delivering dividends that should outpace Treasury’s projected inflation rate of 2.75 per cent for the next financial year.

Take the 13 biggest companies (measured by market cap) from the ‘guilty’ sectors that provide key goods and services to households. Most have been accused of profiteering and subject to multiple – and futile – parliamentary grillings and public inquiries.

Our ‘dirty baker’s dozen’ are Telstra (ASX:TLS), the Big Four Banks, utility and generator Origin Energy (ASX:ORG), AGL Energy (ASX:AGL), Insurance Australia Group (ASX:IAG), fuel refiners and retailers Ampol (ASX:ALD) and Viva Energy (ASX:VEA), Woolworths (ASX:WOW), Coles Group (ASX:COL) and retailer-disguised-as-a-conglomerate Wesfarmers (ASX:WES).

Over the last 12 months, this cohort has returned an average 13 per cent share gain, with a 15 gain since inflation took hold two years ago.

IAG shares have surged 40 per cent over the two years. The group’s December half results showed improved underlying insurance margins – a sure sign that premium increases are more than keeping pace with the burgeoning cost of repairing tech-laden cars even after the tiniest of bingles.

The owner of Kmart, Target, Bunnings and Officeworks outlets, Wesfarmers recorded a 37 per cent two-year gain but appears to be suffering from declining consumer confidence.

The intricacies of the highly-regulated energy market aside, energy utilities are known to outperform at times of elevated inflation and rising interest rates.

Both the targets of unsuccessful takeover tilts, AGL Energy and Origin Energy have surged 52 per cent and 16 per cent respectively over the last two years.

Any capital gains from this duo will take care of the winter heating bills – along with Albo’s $300 – but how about the mortgage stress?

The latest half-year results from the National Australia Bank (ASX:NAB), Westpac (ASX:WBC) and ANZ Bank (ASX:ANZ) and a quarterly update from the Commonwealth Bank (ASX:CBA) show how higher rates have helped them maintain their net interest margins – their profit on lending – whilst keeping loan delinquencies at low levels.

Over the last year NAB shares have gained 27 per cent, followed by Westpac’s 24 per cent surge. Sector leader CBA is 19 per cent to the better while the ANZ has gained 18 per cent.

The key laggard of the dirty dozen, Telstra has declined 17 per cent over 12 months and 9 per cent over two months, with the losses exacerbated by the last week’s revelation of up to 2800 pending job losses and doing-away with automatic CPI increases on phone plans.

Ok – you can’t slash your way to greatness. But with apologies to Mohammed Ali, Telstra is still the greatest in the telephony realms and its depressed valuation is attracting the gaze of bargain hunters and the siren call of a 5 per cent yield.

Despite the outcry about the supermarkets using their oligopoly position to push up prices while squeezing suppliers, Woolworths and Coles shares have retreated 17 per cent and 10 per cent respectively over the last year.

In recent months, though, Coles has outperformed its arch rivals amid Woolies’ problems culminating in the pending departure of CEO Brad Banducci.

While Telstra and the supermarkets have not been winners, the average gains far exceed the returns of the overall ASX200 index: up 6.9 per cent over a year and 7.4 per cent over two years.

Along the way, they pay franked dividends of 3 to 5 per cent, which in after tax terms exceeds the annualised inflation rate of 3.6 per cent.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

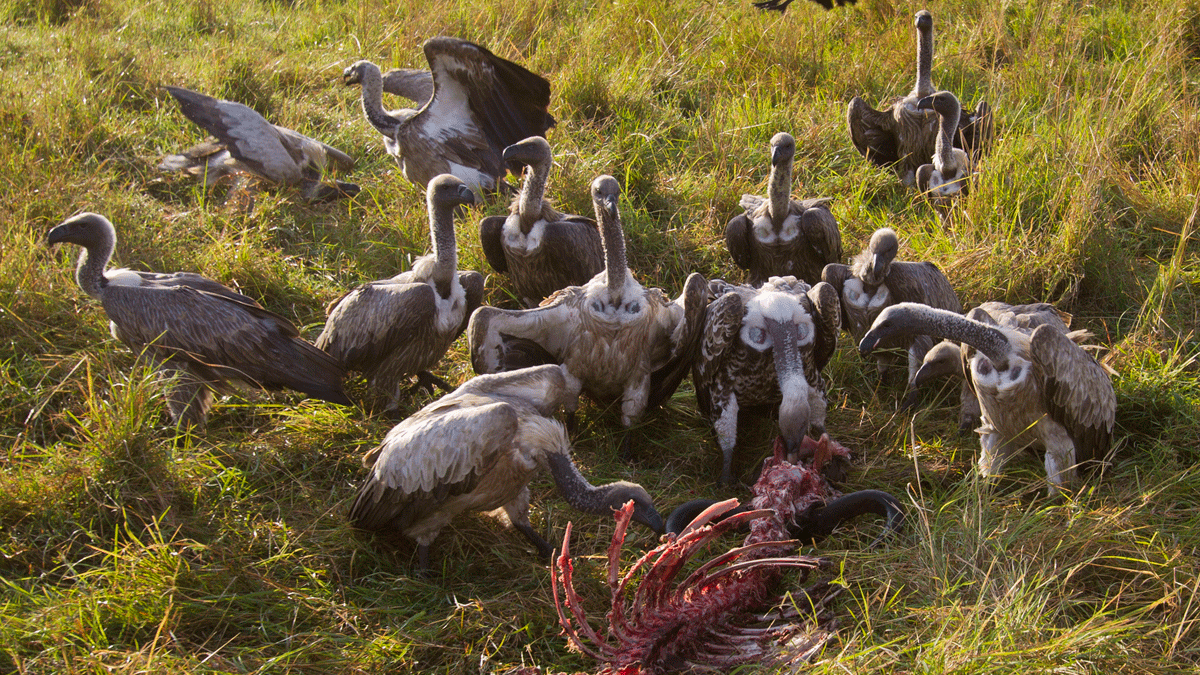

The post CRITERION: If you can’t beat the cost of living carrion-eaters… buy this ‘dirty baker’s dozen’ instead appeared first on Stockhead.